AUTOBILD und Schwacke küren die wertstabilsten Fahrzeuge 2024

- Die wertstabilsten Fahrzeuge aus 15 Segmenten

- Ausbau der Wertmeister-Kategorien im E-Segment

- Klassenübergreifender Wertmeister: der Kia Picanto

Die Sieger stehen fest! Auch in diesem Jahr haben AUTOBILD und Schwacke gemeinsam die Wertmeister 2024 ermittelt. Insgesamt fast 10.000 Fahrzeugtypen wurden im Rennen um den renommierten Titel akribisch und mit gewohnt hohem Anspruch unter die Lupe genommen, um die wertbeständigsten Fahrzeuge zu ermitteln.

In einem aufwändigen Prozess analysiert das Schwacke-Expertenteam mehrere hundert Faktoren und Parameter, um eine präzise Restwertprognose zu erstellen, darunter Motorisierung, Ausstattungsversion,

gängige Sonderausstattungen und viele mehr. Als Bewertungsgrundlage für den Wertmeister dient ein Prognose-Zeitraum von vier Jahren mit einer für das Segment durchschnittlichen Kilometerlaufleistung.

Warum ist der Fahrzeug-Restwert eigentlich so wichtig?

Restwerte sind in allen Bereichen der Automobilindustrie relevant: Der Wiederverkaufswert eines Fahrzeugs hängt maßgeblich vom Restwert ab – für Privatkundinnen und -kunden durchaus ein ausschlaggebendes Argument für die Kaufentscheidung eines neuen Autos. Im Leasing- und Finanzbereich beeinflusst der Restwert in nicht unerheblichem Maß die Höhe der Leasingrate. Und für Fahrzeughersteller kann ein stabiler Restwert wesentlich zum Markterfolg eines neuen Modells beitragen.

Wenn ein Fahrzeug den Titel “Wertmeister“ für sich beanspruchen kann, ist das eine hohe Auszeichnung für seine Wertbeständigkeit.

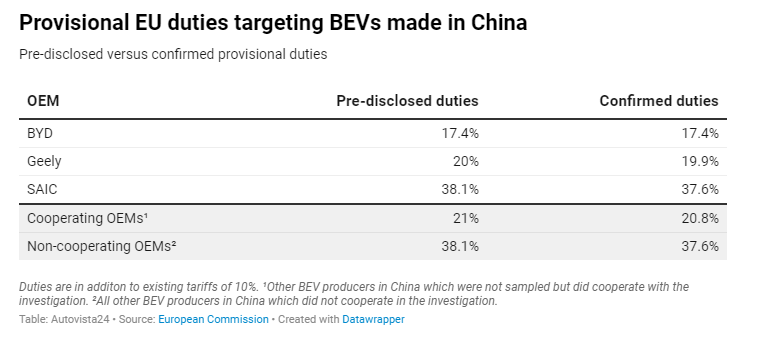

Ausbau der Wertmeister-Kategorien im E-Segment

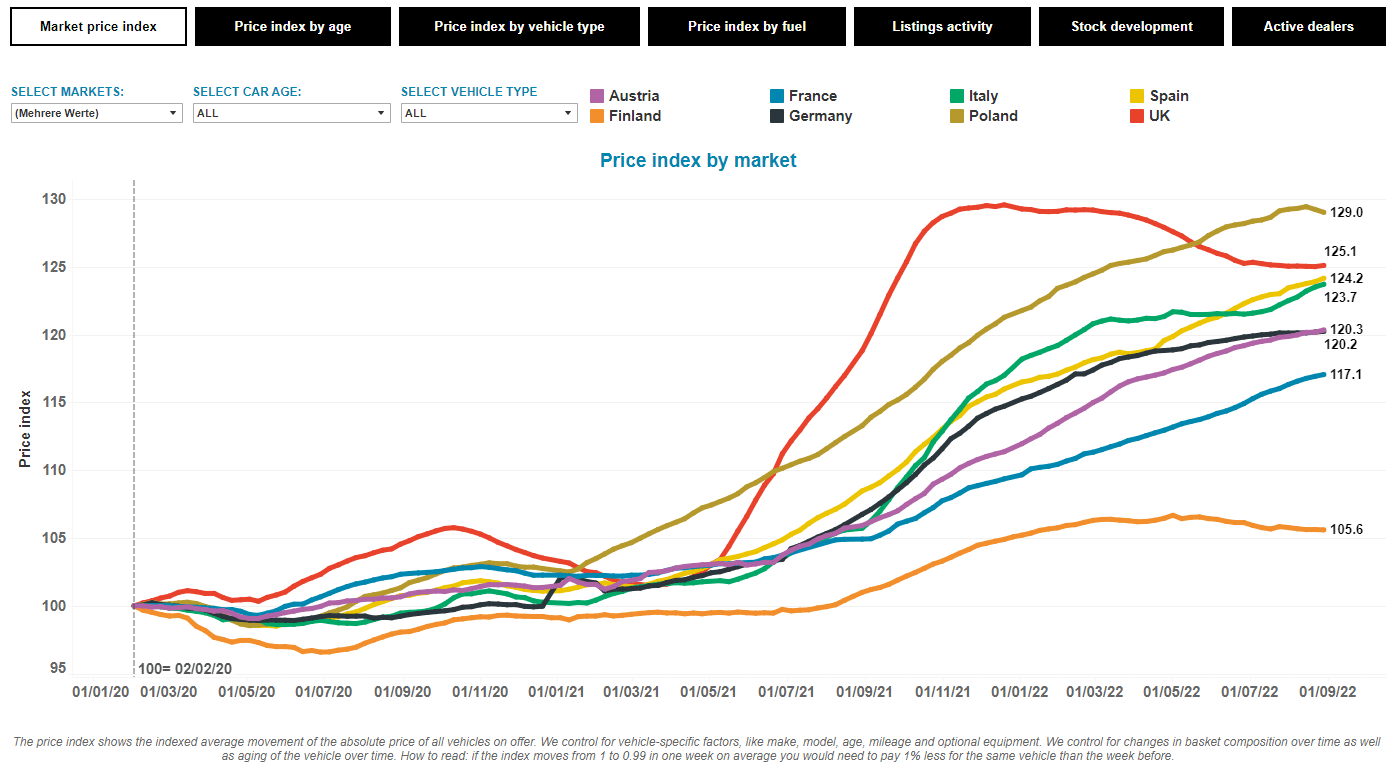

Die Verkehrswende und der technologische Wandel nehmen an Fahrt auf. In den kommenden Jahren wird das Angebot an neuen E-Modellen weiterwachsen. Der rasante Fortschritt in den Bereichen Elektromobilität und Fahrzeugtechnologie sorgt für Unsicherheit im Markt in Bezug auf die Wertenwicklung bei E-Fahrzeugen. Ein Sachverhalt, der auch beim Wertmeister Berücksichtigung findet.

2015 wurden Elektrofahrzeuge neu ins Titelrennen um den Restwert-Champion aufgenommen. In diesem Jahr gibt es nun erstmals vier Wertmeister im E-Segment – aufgeteilt nach Fahrzeugklassen.

Die Entscheidung, den Wertmeister im Hinblick auf die aktuelle Marktsituation zu erweitern und für mehr Transparenz rund um das Thema Werterhalt bei E-Fahrzeugen zu sorgen, ist naheliegend, wie Thorsten Barg, Geschäftsführer, Schwacke (Autovista Group, part of J.D. Power), aufzeigt:

“Noch nie gab es beim Wertmeister so viele Klassen, wie in diesem Jahr. Das Angebot an Elektrofahrzeugen wächst stetig und dem tragen wir natürlich Rechnung. Dabei zeigt der Wertmeister 2024 auch auf, dass viele Elektrofahrzeuge in Sachen Werterhalt deutlich besser als ihr Ruf sind. Dennoch, ihre Verbrenner-Pendants weisen in den jeweiligen Segmenten immer noch die bessere Restwert-Performance auf.“

Das Markenumfeld bei den Elektrofahrzeugen ist bunt gemischt, die Bandbreite ist groß: Die ersten vier Sieger in den neu eingerichteten Kategorien „Kleinwagen, SUV Small“, „untere Mittelklasse, SUV Medium“, „Mittelklasse, SUV Medium D“ und „Oberklasse, SUV Large“ sind der Reihe nach: der Citroen e-C3 Aircross, der neue Ford Explorer, der Polestar 2 Single und der Volvo EX90.

Der Citroen e-C3 Aircross hat bei den E-Fahrzeugen segmentübergreifend mit einem Werterhalt von 61,3% klar die Nase vorn. Alle anderen Modelle in den Top 3 der jeweiligen Kategorien überzeugen mit einem immer noch tadellosen Restwert von durchschnittlich 56% nach vier Jahren.

And the winner is…

In den letzten beiden Jahren stellte Mercedes-Benz das Modell mit dem klassenübergreifend geringsten prozentualen Wertverlust. In diesem Jahr musste sich Mercedes einem Fahrzeug aus koreanischer Produktion geschlagen geben: Das wertstabilste Modell über alle Kategorien ist der Kia Picanto 1.2 (Kategorie Kleinstwagen) mit einem Werterhalt von 69,3% nach vier Jahren.

Der Picanto ist gleichzeitig auch das Fahrzeug mit dem geringsten monetären Wertverlust. Nachdem sich im letzten Jahr der Kia Rio diese Position sichern konnte, stellt Kia zum zweiten Mal in Folge das Fahrzeug mit dem höchsten Restwert.

In den Kategorien Ober- und Luxusklasse haben die deutschen Marken die Nase vorn – wie auch schon in den Jahren zuvor. BMW, Mercedes-Benz, Audi und Porsche teilen die sechs Platzierungen in diesen beiden Kategorien unter sich auf.

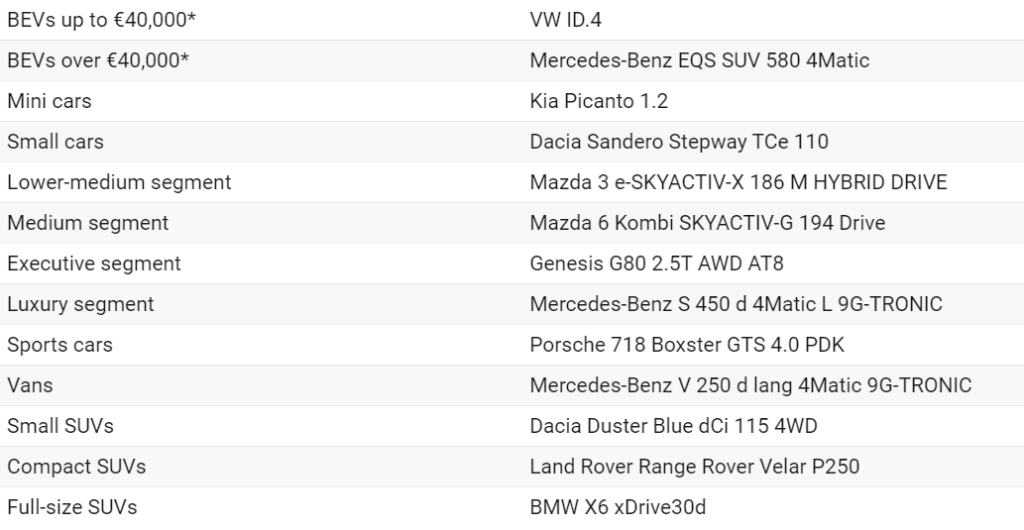

Die Wertmeister 2024 im Überblick

| Elektrofahrzeuge (Kleinwagen, SUV Small) | Citroen e-C3 Aircross |

| Elektrofahrzeuge (untere Mittelklasse, SUV Medium C) | Ford Explorer Dual-Elektromotor Extend. Range AWD 79kWh |

| Elektrofahrzeuge (Mittelklasse, SUV Medium D) | Polestar 2 Single Motor 70kWh |

| Elektrofahrzeuge (Oberklasse, SUV Large) | Volvo EX90 Twin Motor AWD |

| Kleinstwagen | Kia Picanto 1.2 |

| Kleinwagen | Dacia Sandero Stepway TCe 110 |

| Untere Mittelklasse | Mazda 3 e-SKYACTIV-X 186 M |

| Mittelklasse | Skoda Superb Combi 2.0 TSI DSG |

| Oberklasse | BMW 540d xDrive Touring Aut. |

| Luxusklasse | Mercedes-Benz S 450 d 4Matic L 9G-TRONIC |

| Sportwagen | Porsche 911 Carrera PDK |

| Vans | Mercedes-Benz V 250 d lang 4Matic 9G-TRONIC |

| Kompakte SUV | Citroen C3 Aircross Hybrid 136 ë-DSC6 |

| Mittlere SUV | BMW X3 20d xDrive |

| SUV | Land Rover Range Rover Sport D300 |

Dieser Inhalt wird Ihnen präsentiert von Autovista24.

Schließen

Schließen