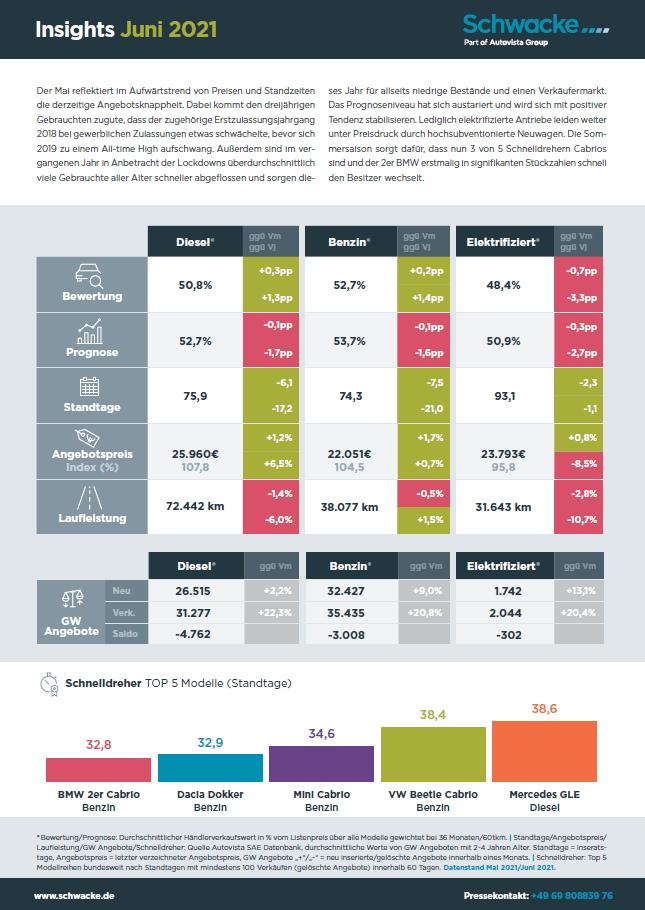

Der Mai reflektiert im Aufwärtstrend von Preisen und Standzeiten die derzeitige Angebotsknappheit. Dabei kommt den dreijährigen Gebrauchten zugute, dass der zugehörige Erstzulassungsjahrgang 2018 bei gewerblichen Zulassungen etwas schwächelte, bevor sich 2019 zu einem All-time High aufschwang. Außerdem sind im vergangenen Jahr in Anbetracht der Lockdowns überdurchschnittlich viele Gebrauchte aller Alter schneller abgeflossen und sorgen dieses Jahr für allseits niedrige Bestände und einen Verkäufermarkt. Das Prognoseniveau hat sich austariert und wird sich mit positiver Tendenz stabilisieren. Lediglich elektrifizierte Antriebe leiden weiter unter Preisdruck durch hochsubventionierte Neuwagen. Die Sommersaison sorgt dafür, dass nun 3 von 5 Schnelldrehern Cabrios sind und der 2er BMW erstmalig in signifikanten Stückzahlen schnell den Besitzer wechselt.

Fuel Type: Diesel

Carmakers successfully pooled emissions to meet 2020 EU targets

Autovista Group senior data journalist Neil King investigates the emissions performance of major carmakers in the EU in 2020. In this first part, King discusses pooling and focuses on manufacturers that successfully spread their emissions over a larger fleet average.

The issue of CO2 targets has given many carmakers a headache in recent years. Until 2016, many relied on diesel engines to help them achieve their goals. Yet, the collapse in trust and sales of this technology left manufacturers scrambling for alternatives, especially as consumers switched to the higher CO2-emitting petrol cars and SUVs.

The best option was to push ahead with plans for both hybrid and electrically-chargeable vehicles (EVs). Some carmakers were more advanced in developing these technologies, which led to several manufacturers combining their fleets into pools, spreading out CO2-emission figures over a larger area and reducing the chances of a fine.

Manufacturers established a number of pools to help meet their 2020 and 2021 targets, and all but one was successful last year. Volkswagen Group, part of the biggest pool by market share, missed its projection by a small margin, just 0.5g. However, every carmaker managed to reduce their average fleet emissions, compared to 2019.

Running the numbers

From 2021, the average emissions target for new cars registered in the EU is set at 95g/km CO2. For every 1g/km of CO2 a manufacturer exceeds its average emissions target by, it is fined €95, multiplied by its volume of new-car registrations in the preceding year.

However, the highest-polluting 5% of new cars registered in 2020 are excluded from the 2021 fines calculations, which serves as a transitional phase for carmakers. Based on analysis of data distribution, Autovista Group calculates that this reduced average CO2-emissions figures by about 7%. From 2022 onwards, however, full compliance of all new cars is required (i.e. new cars registered in 2021 onwards).

Pool party

The idea of a pool is simple. A carmaker struggling to meet targets reaches out for help to those who are more successfully managing their CO2 output. Once in the pool, both sets of emissions figures are combined and spread out over an expanded fleet, reducing the average and, in most cases, helping the struggling company achieve its target and avoid a fine. The compliant manufacturer will likely receive financial compensation for its help.

Of all the major manufacturers in Europe, Toyota was in the strongest position to meet its emissions target in 2020. Compared to their 2017 level, the Japanese group only had to reduce their average fleet emissions by 9g CO2/km (9%). The manufacturer has not revealed detailed emissions figures but has confirmed it met its target, supported by strong demand for its hybrid-electric vehicles. Therefore, the OEM was able to help fellow Japanese manufacturer Mazda, which only launched its first BEV, the MX-30, in 2020.

Similarly, Renault, Nissan and Mitsubishi pooled their emissions. The Renault Group itself benefitted from the Zoe BEV and its extended range of E-Tech hybrid and plug-in hybrid (PHEV) variants of models such as the Clio, Captur and Megane. Nissan’s fleet-average emissions were aided by the Leaf BEV and, combined, Renault-Nissan was only 2g/km short of its target in the first half of 2020.

In order to comply with European emissions targets going forward, Mitsubishi Motors will source models from Renault that meet regulatory requirements. ‘Starting 2023, Mitsubishi Motors will sell two “sister models” produced in Groupe Renault plants, which are based on the same platforms but with differentiations, reflecting the Mitsubishi brand’s DNA,’ Renault revealed.

Recall issues

As an example of the fine lines that manufacturers walk to meet their emissions targets, Ford was forced to consider pooling towards the end of 2020. The carmaker issued a recall of its Kuga plug-in hybrid (PHEV) in August of last year. As the carmaker did not have a battery-electric vehicle (BEV) in its fleet, it was heavily reliant on the PHEV to lower CO2 levels.

Ford had already faced a higher mountain to climb, with its 2017 emissions figures showing it needed to reduce CO2 output across its fleet by 26g/km (21%). The recall led the manufacturer to announce it was considering pooling, in order to meet its targets.

‘The current issues with the Kuga PHEV, resulting in a stop-ship and stop-sale have affected our plan to meet the EU’s 2020 emissions regulations for passenger vehicles on our own,’ Ford said to Autovista Group at the time. ‘Therefore, just as many other OEMs have done in Europe, we now intend to join an open pool with other OEMs for passenger vehicles.’

Ford entered into an agreement with Volvo in November. Although the US carmaker has not provided detailed figures, it did meet its 2020 target, likely thanks to this pool.

Sought after

Fiat Chrysler Automobiles (FCA) faced the biggest challenge to comply with European emissions targets. The US-Italian group needed to lower their emissions by 29g/km (24%) compared to 2017 levels. This largely explains why FCA pooled its emissions figures with US BEV manufacturer Tesla.

The move brought FCA’s average CO2 emissions down by offsetting the company’s petrol and diesel vehicles from Fiat, Jeep, Alfa Romeo and Maserati against the zero-emission outputs of Tesla’s BEVs. CEO Mike Manley already suggested in August 2019 that the Italian carmaker would be compliant because of the regulatory credit deal with Tesla. Honda was subsequently brought into this pool too.

Tesla is the largest BEV-only carmaker in Europe, having entered the market in 2008 with its limited production Roadster, before launching its first BEV sedan, the Model S, in 2012. The manufacturer built up a base of BEV models while other carmakers continued to promote ICE and was well-placed to capitalise when consumers started considering alternative options. Therefore, its CO2 credits would provide a good opportunity for carmakers to reduce their overall levels. While the US company sells fewer vehicles than bigger players in the automotive market, average emissions across its entire fleet will be no higher than zero.

The FCA annual report states that CO2 emissions data for last year is not yet available but: ‘the 2020 result is expected to move toward the 95g CO2/km EU average target due to the adoption of a multi-faceted approach which leveraged conventional technologies, high-voltage electrification, pooling arrangement contribution and compliance rules for 2020.’

‘The quantity of CO2 emissions in 2021 will be affected not only by market evolution (such as the expected reduction of diesel market share) but also by the commercialisation of low-emission and electrified vehicles. Finally, according to applicable EU regulations, current pooling arrangements for emissions compliance for passenger cars entered into by FCA are expected to apply in 2021,’ FCA added.

However, at the start of 2021, FCA merged with PSA Group to form Stellantis. CEO of the new manufacturing group, Carlos Tavares, has since been reported to have terminated the agreement with Tesla. As PSA Group met its emission targets in 2020, and as FCA’s figures will now merge with these, the company should be in a position to achieve its CO2 goals at the end of this year.

In the next instalments of this series, Neil King will explore those manufacturers who met their emissions targets on their own and carmakers who failed to reduce CO2 sufficiently, whether they pooled or not.

Hitting the target: Lone carmakers that successfully reduced their emissions

In the second part of a three-part series on meeting CO2 emissions targets, Autovista Group senior data journalist Neil, King considers the manufacturers that successfully met their respective targets without pooling emissions.

Last year was the first step for carmakers to meet strict CO2 emissions targets. Many decided to pool with other carmakers to spread their emissions over a larger fleet size. However, several carmakers chose to go it alone.

While some may have been confident in their own fleet-average emissions, there may have been other reasons behind the decision for a few carmakers. One may have been control, having no external influence on their own numbers. Another may have been down to cost.

Pooling with other manufacturers may ensure meeting the target, but requires a financial contribution to ‘partner’ companies. This financial contribution would be a waste of finances if carmakers believe they can meet their targets alone. Looking back at those who pooled, many who instigated discussions were forced into lowering their potentially fine-inducing emissions. Others were so confident they looked to help those that were struggling.

So, to recap, from 2021, the average emissions target for new cars registered in the EU is set at 95g/km CO2. For every 1g/km of CO2 a manufacturer exceeds its average emissions target by, it is fined €95, multiplied by its volume of new-car registrations in the preceding year. However, the highest-polluting 5% of new cars registered in 2020 are excluded from the 2021 fines calculations, which serves as a transitional phase for carmakers.

While carmakers do not publicise their thoughts about pooling, two that could have considered control and finances would be Daimler and BMW. Both met their respective emissions targets independently, and had financial concerns leading up to the deadline for emissions targets.

BMW beats target

BMW had set aside around €1 billion in 2019 to pay off an expected fine for its alleged part in an emissions cartel. However, the carmaker beat its 104g/km CO2 target by 5g in 2020, reducing its new-vehicle fleet emissions by 22% compared to 2019.

‘Despite the coronavirus pandemic, we delivered about a third more electrified BMW and Mini vehicles to customers than the previous year. Our plug-in hybrids were highly sought-after, as were our new fully-electric models, the BMW iX3 and Mini Cooper SE. Because we started our preparations early, we were able to significantly overfulfil our assigned CO2 limit by about 5g/km. This was never in any doubt for us. Our EU fleet emissions are currently at 99g/km, and we will also meet the 2021 requirements,’ the company stated.

A manufacturer that had a well-documented financial slide throughout 2019 and 2020 was Daimler. Therefore, going it alone made sense, maintaining control of its figures and finances – however, it was also a risk. In 2019, Daimler reported average CO2 emissions of 137g/km, way above its individual target. It reported meeting its fleet-average emissions target of 104g/km, reducing output year-on-year by 24%.

‘On the basis of WLTP, we expect our fleet average in Europe (European Union, Norway and Iceland) to decrease again significantly in 2021 compared with the figures for the previous year. This development will be driven in particular by the rising proportion of battery-electric vehicle models and plug-in hybrids in our new-car fleet,’ the company commented.

The fact that both BMW and Daimler met their targets also shows the level of commitment the carmakers put into reducing their CO2 levels. German manufacturers heavily relied on developing diesel technology in the early part of this century, relying on them to meet CO2 emissions checks. Yet the collapse of the diesel market since 2016 has meant German companies in particular have needed to speed up the rollout of hybrid (HEV), plug-in hybrid (PHEV) and battery-electric vehicles (BEVs).

Stellantis

In the first part of this series, Autovista Group noted that Fiat Chrysler Automobiles (FCA) had pooled with Tesla and successfully reduced its emissions below its individual target. Last year’s figures do not take into account the merger between PSA Group and FCA to create Stellantis. Therefore, the French partner relied solely on figures from its Peugeot, Citroen, Opel/Vauxhall and DS marques.

PSA Group did open a pool, but it only featured those brands owned by the group. Final figures were not available, but the company clarified that it had met its targets for 2020.

‘Groupe PSA remained focused on CO2 performance and met European targets in 2020, in line with prior commitments. It complied with its CO2 objectives both on the optimisation of ranges in terms of internal combustion engine (ICE) emissions and on the growth of LEV [light-electric vehicle] sales volumes (a significant increase with 120,000 registrations in 2020),’ according to the group’s financial report for 2020 (page F-48).

PSA Group’s figures will be reported alongside FCA’s in 2021, as part of the new Stellantis business. This is also likely to affect the pool FCA runs with Tesla and Honda. The Italian side of the new business may not need to rely on the zero-emission specialist carmaker to meet its targets, which would create a dent in Tesla’s finances for this year. CEO of the new manufacturing group, Carlos Tavares, has been reported to have already terminated the agreement with Tesla.

Koreans go it alone

Korean carmakers Hyundai and Kia also managed to meet their respective emissions targets on their own in 2020, with no concern voiced in the lead-up to the deadline. ‘Hyundai’s strategy towards zero-emission mobility and the high proportion of ZEVs [zero-emission vehicles] among its new-car sales were key factors enabling the company to meet its CO2 target,’ the company stated in January.

As for Kia, significant growth in demand for hybrid and electric vehicles helped the brand reduce its emissions. Electrified powertrains accounted for one in four sales in Europe last year.

‘Throughout the pandemic, we were able to continue launching new and upgraded vehicles, and continued to electrify more of our product line-up to meet growing consumer demand for advanced powertrains,’ commented Won-Jeong (Jason) Jeong, president of Kia Europe.

The work for all these carmakers is far from over. Not only do they need to ensure their full fleets meet targets by the end of 2021, but they also need to consider stricter reductions in CO2 emissions for 2025 and 2030. This is one significant reason why the number of electrically-chargeable vehicles (EVs) being manufactured is on the rise. The speed at which they need to roll out these low and zero-emission vehicles will become clearer once the final 2021 numbers are revealed.

In the first part of this series, King focused on manufacturers that successfully pooled their emissions with smaller manufacturers to meet their respective targets. The final part will look at those who missed their targets in 2020 and how they plan to meet them by the end of this year.

Schwacke Insights Mai 2021 – monatliche Kennzahlen im Überblick

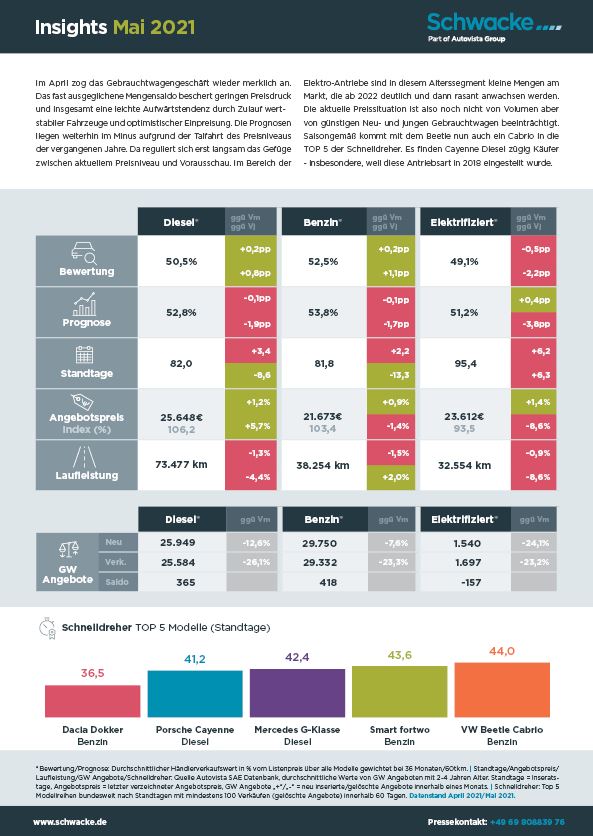

Im April zog das Gebrauchtwagengeschäft wieder merklich an. Das fast ausgeglichene Mengensaldo beschert geringen Preisdruck und insgesamt eine leichte Aufwärtstendenz durch Zulauf wertstabiler

Fahrzeuge und optimistischer Einpreisung. Die Prognosen liegen weiterhin im Minus aufgrund der Talfahrt des Preisniveaus der vergangenen Jahre. Da reguliert sich erst langsam das Gefüge zwischen aktuellem Preisniveau und Vorausschau. Im Bereich der Elektro-Antriebe sind in diesem Alterssegment kleine Mengen am Markt, die ab 2022 deutlich und dann rasant anwachsen werden. Die aktuelle Preissituation ist also noch nicht von Volumen aber von günstigen Neu- und jungen Gebrauchtwagen beeinträchtigt. Saisongemäß kommt mit dem Beetle nun auch ein Cabrio in die TOP 5 der Schnelldreher. Es finden Cayenne Diesel zügig Käufer – insbesondere, weil diese Antriebsart in 2018 eingestellt wurde.

Are EVs as green as they seem?

The last year has been dominated by a single health emergency that brought the world to its knees. But for decades, scientists and campaigners have been warning of another impending crisis. As governments put environmental regulations in place, carmakers are transitioning into clean mobility companies. Spearheading this change, electrically-chargeable vehicles (EVs) appear poised to take the helm from internal combustion engines (ICEs). But for this handover to work, these electric models must prove to be environmentally advantageous. Autovista Group Daily Brief Journalist Tom Geggus asks, are EVs as green as they seem?

According to the European Commission, passenger cars are responsible for around 12% of total EU CO2 emissions, putting the automotive industry in the green spotlight. A poll of 15 European cities recently revealed nearly two-thirds of urban residents back a ban on the sale of new petrol and diesel cars by 2030. OEMs and mobility providers are also supporting a faster transition to zero-emission transport. Volvo Cars, Uber and LeasePlan are among a group of companies calling for an end date to new combustion car purchases in Europe no later than 2035. This would leave a large ICE-sized hole for EVs to plug. But considering its entire lifetime, is an electrified vehicle that much cleaner than a petrol or diesel-powered one?

Significantly smaller footprint

Published in March last year, research from the universities of Cambridge, Exeter and Nijmegen showed that in 95% of the world, an electric car has a significantly smaller carbon footprint than one powered by fossil fuels. Dr Florian Knobloch, University of Cambridge fellow, German Federal Ministry policy advisor, and the paper’s lead author, spoke with Autovista Group’s Daily Brief about the findings.

The academic team carried out extensive life-cycle assessments of emissions produced through vehicle use, as well as production and waste processing. ‘When you look at the production stage, it takes significantly more energy and material input due to the battery,’ Dr Knobloch said. But the EV then makes up for this larger burden across its entire lifetime thanks to far lower running emissions.

‘It is a myth that electric cars do increase emissions, even on a lifetime basis,’ he said. ‘In most parts of the world already, today EVs will decrease emissions, even if you factor in everything from production to recycling.’

‘A snowball effect’

When dividing the world into 59 regions, the research revealed that in 53, electric cars are already less emissions-intensive than one powered by petrol or diesel. These regions include Europe, the US and China. In fact, lifetime emissions from EVs were found to be 70% lower than petrol cars in countries like France and Sweden, where large amounts of electricity are generated through renewable and nuclear sources. However, the same cannot be said for counties like Poland, where dependence on coal-fuelled power stations lingers.

But as grids worldwide are rewired with decarbonisation in mind, even these regions will see more reason to go electric. So, as EVs become increasingly efficient, they will outstrip ICEs which have already reached near-peak efficiency. Dr Knobloch points out that even with the inclusion of greener technology like biofuels, there is little chance for the carbon footprint of ICE vehilces to greatly improve.

This transition to electromobility does take time. Confidence in EVs still needs to build up: from the early adopters to the mainstream. ‘Every EV you buy now increases the chance of more EVs being bought in the future,’ Dr Knobloch explained. As consumers are exposed to an increasing number of EVs, a snowball effect will take place with confidence growing alongside adoption, encouraging more people to take the electric leap. The study projects that globally, half of cars on average could be electric by 2050. This would lower global CO2 emissions by up to 1.5 gigatons annually.

A comparative tool

In Europe, clean-transport campaign group Transport and Environment (T&E), found that electric cars emit on average almost three times less CO2 than their ICE equivalent. Again, this figure considers wider impact, including the sourcing of battery materials, electricity production, and even power-plant construction. To illustrate the difference between the lifetime emissions of EVs and ICEs, T&E created a tool to compare drive types, considering the year of purchase, vehicle type and location, as well as electricity used for battery production.

Lucien Mathieu, manager overseeing road vehicles and e-mobility analysis at T&E, spoke with Autovista Group’s Daily Brief. As the tool’s creator, he explained it aims to combat other bias analysis of electric-car emissions, that might rely on outdated data, particularly given the rapid advance of EV technology. Using the most up-to-date information, T&E’s tool reveals CO2 emissions per kilometre, as well as in tonnes over lifetime.

For example, comparing two medium-sized cars bought in 2020, T&E’s tool reveals the electric car, on average, is responsible for 90 grammes of CO2 per kilometre versus petrol with 253 grammes. Considering tonnes of CO2 over distance driven, the EV’s ‘carbon debt’ from production is paid off quite quickly thanks to its low-usage emissions. This compares starkly to an ICE car, which is far less efficient when converting its fuel into movement.

This canyon between EV and ICE only looks set to grow as battery technology continues to advance, while fossil-fuel cars have already achieved close to their peak efficiency. A T&E study recently calculated that an EV battery uses 30 kilograms of raw materials with recycling, compared to the 17,000 litres of petrol burned by the average car.

‘The valuable minerals mined to make electric-car batteries will be used and reused unlike those of oil,’ said Greg Archer, UK director of T&E. ‘Over its lifetime, an average-engined car would burn through a stack of oil barrels, 25 storeys high, creating about 40 tonnes of CO2 and worsening global warming. In comparison, only 30 kilograms of metals would be lost each time an electric-car battery is recycled – roughly the size of a football.’

This gap will increase as advancements drive down how much lithium is needed to make a battery by half over the next decade. Cobalt will drop by over three-quarters and nickel by around a fifth. So, as EVs develop, T&E plans to keep their tool updated with the latest available evidence, as well as expanding its scope to include plug-in hybrids (PHEVs). But of course, EVs also benefit from technologies developing outside of their own powertrains.

Powering vehicles

At the end of last year, more than 3,500 European power companies, represented through the federation for the European electricity industry, Eurelectric, came out in support of a minimum 55% reduction in greenhouse gas emissions by 2030. As more electricity generators and distributors throw their weight behind cleaner-energy solutions, including the use of more renewables, EVs can be expected to become greener.

Speaking with Autovista Group’s Daily Brief, Petar Georgiev, climate and E-mobility lead at Eurelectric, pointed to a larger picture when considering the energy behind EVs. ‘You do have to keep in mind what the actual carbon footprint is in different countries, at different times, and also how it is changing, because for us in the power sector, we clearly see that the grid is becoming cleaner and cleaner,’ he said. ‘But if we have to wait to have a fully renewable grid, and then only start to integrate renewables, that would probably be a very big mistake.’

Because an EV’s CO2 levels can be lowered long before its first charge, it makes sense to take a holistic approach to EV emissions and electricity usage. For example, manufacturers can opt for more efficient production methods, even incorporating renewables into the process. Furthermore, which cars plug into electromobility will be hugely important.

Eurelectric recently identified the electrification of Europe’s vehicle fleets as a ‘catalyst for clean mobility throughout the 2020s.’ The continent’s fleet is made up of 63 million cars, vans, buses, and trucks, operated by private companies or public authorities. The federation explained, however, that despite only making up 20% of the parc, these vehicles account for 40% of all kilometres travelled. They also account for 50% of CO2 emissions from transport. ‘Electrification of car fleets can be a real game-changer,’ Kristian Ruby, secretary-general of Eurelectric said. ‘It comes with tangible reductions of total costs of ownership and CO2 emissions. So, it is a good deal both for fleet owners and society at large.’

While the electrification of vehicles contains the potential to reduce CO2 emissions dramatically, it is enormously dependent upon usage. So, when asked, ‘are EVs as green as they seem?’ the answer is yes, but adoption rates will determine their success.

Schwacke Insights Q1 2021 – Zulassungen aus Restwertsicht

Der Markt ist Lockdown-bedingt im ersten Quartal deutlich unter den Vorjahren, aber mit Besonderheiten. So scheinen die Flottenzulassungen in Summe nahezu unbeeindruckt, offenbaren aber im Treibstoffmix die Dramatik. Durch enormes Wachstum wurden wie erstmalig im letzten Quartal mehr elektrifizierte Antriebe zugelassen als Benziner und müssen 2023-2025 gebraucht vermarktet werden. Und Mildhybride zählen nicht mal dazu. Bei den kurzfristigen Remarketing-Kanälen Handel, Hersteller und Vermieter sieht der Elektroschub ähnlich aus, reicht aber lang nicht, um auf das ohnehin niedrige Vorjahresniveau zu kommen. Händler und Hersteller folgen dem starken Trend zwar mit mehr E-Modellen, aber längst nicht so stark wie die mehrfach profitierenden Dienstwagenfahrer und Flottenbetreiber. Es bleibt weiterhin die dringende Aufgabe, die Nachfrage nach gebrauchten E-Fahrzeugen zu stimulieren.

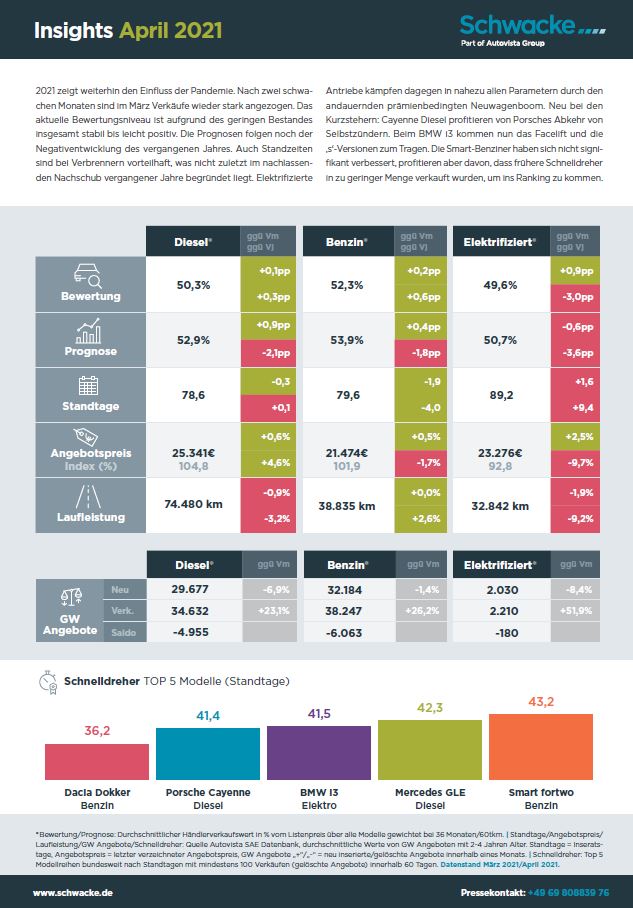

Schwacke Insights April 2021 – monatliche Kennzahlen im Überblick

2021 zeigt weiterhin den Einfluss der Pandemie. Nach zwei schwachen Monaten sind im März Verkäufe wieder stark angezogen. Das aktuelle Bewertungsniveau ist aufgrund des geringen Bestandes insgesamt stabil bis leicht positiv. Die Prognosen folgen noch der Negativentwicklung des vergangenen Jahres. Auch Standzeiten sind bei Verbrennern vorteilhaft, was nicht zuletzt im nachlassenden Nachschub vergangener Jahre begründet liegt. Elektrifizierte Antriebe kämpfen dagegen in nahezu allen Parametern durch den andauernden prämienbedingten Neuwagenboom. Neu bei den Kurzstehern: Cayenne Diesel profitieren von Porsches Abkehr von Selbstzündern. Beim BMW i3 kommt nun das Facelift und die ‚s‘-Versionen zum Tragen. Die Smart-Benziner haben sich nicht signifikant verbessert, profitieren aber davon, dass frühere Schnelldreher in zu geringer Menge verkauft wurden, um ins Ranking zu kommen.

Launch Report: BMW iX3 – conventional and balanced electrification

The iX3 is BMW’s first pure-electric X model and is the most conventional, being effectively a battery-electric vehicle (BEV) version of the best-selling X3.

The iX3 offers good performance, with strong linear acceleration – as usual for a battery-electric vehicle (BEV). The model also strikes a good balance between power and battery capacity, with competitive electricity consumption. In terms of agility and dynamics, the iX3 is slightly better than its direct rivals overall. As the battery is located under the car, this also explains the good roadholding.

Standard equipment is comprehensive, including three-zone climate control, heated and powered front seats (with memory function on the driver’s side), BMW Teleservices and wireless phone charging. Safety features include emergency-assist and rear cross-traffic alert. The 458km range of the iX3 is second only to the Jaguar I-Pace’s 470km range, and it has the fastest charging time when connected to an 11kw AC wallbox, of 7.5 hours.

In addition to BMW’s strong brand image, the iX3 is supported by the company’s longer expertise in electrification. This started with the i3, which has been on the market since 2013, and was followed by plug-in hybrid (PHEV) engines offered on different models in the range, including one for the brand’s X family.

As the first conventional BEV from BMW, the iX3 compares well against key competitors. It is offered at an attractive entry price point and the popularity of both the brand and the X3 range should ensure plenty of demand. Given that the iX3 is very close to the X3, BMW’s D-SUV range is now available in diesel, petrol, PHEV and BEV versions.

Click here or on the image below to read Autovista Group’s benchmarking of the BMW iX3 in France, Spain and the UK. The interactive launch report presents new prices, forecast RVs and SWOT (strengths, weaknesses, opportunities and threats) analysis.

German registrations start slow recovery in March

New-car registrations in Germany increased 35.9% in March, according to the latest figures from the Kraftfahrt-Bundesamt (KBA).

The figure was inflated due to the country’s first COVID-19 lockdown closing dealerships from mid-March in the previous year. However, at that time, registrations performed well compared to other countries. While Spain, France and Italy posted losses of 69.3%, 72.2% and 85.4%, respectively, Germany only saw a decline of 37.7%.

At the end of the first quarter, new registrations totalled 656,452 units, down 6.4% compared to the first three months of last year. This is despite dealerships being closed. The country’s market also suffered due to a VAT increase, with taxes rising from 16% to 19% at the beginning of the year. Autovista Group estimates that around 40,000 registrations were pulled forward into December last year as a result.

Brand increases

All domestic brands showed positive growth in March 2021, the strongest being Smart with a 304.4% increase. Double-digit increases were recorded by Opel (75.1%), Mini (58%), Porsche (55%), Volkswagen Passenger Cars (VW) (39.1%), Mercedes (36.7%), Audi (17.6%) and BMW (17%). VW claimed the largest share of new registrations, taking 19.3% of the market.

Alfa Romeo showed the most significant increase among the imported brands, up by 114.6%. Fellow Stellantis stablemate Peugeot saw sales grow 78.4% while Tesla enjoyed a 63.6% boost. However, Honda (-33.3%), Mitsubishi (-30%) and Jaguar (-10%) were among those to see sales decline in the month.

Electric closes the gap

In terms of fuel type, the market for battery-electric vehicles (BEVs) achieved a significant increase of 191.4%, with a market share of 10.3%. With German car brands such as VW and BMW increasing their focus on electrification, there now seems to be an appetite for the technology amongst buyers. Plug-in hybrid (PHEV) models achieved a 12.2% market share, with sales increasing 277.5% in the month.

The swing to electric drives is more evident when internal combustion engines (ICE) sales are considered. New registrations of passenger cars with petrol engines increased by 7.1%. However, the market share was just 39.4%. The sale of diesel models continued to decline, with 5% fewer in March 2021 for a 22.1% market share. For the second successive month, diesel sales were outpaced by those of hybrids. When including standard and PHEV models, this powertrain type took 27.8% of the market.

The figures, therefore, show that 38.1% of registrations in Germany during the last month were non-ICE models. This is just 1.3% below the market share of petrol in March. It may not be long until sales of these vehicles outpace those of more traditional powertrains.

Germany extended its lockdown period to 18 April following a spike in infection cases. However, the Federation of Motor Trades and Repairs (ZDK) argued that vehicle dealers should be allowed to reopen fully. The group’s main argument is that while a hairdresser, with a floor space of 10m2, is allowed to have one customer, car showrooms with a floor space of 500m2 cannot open.

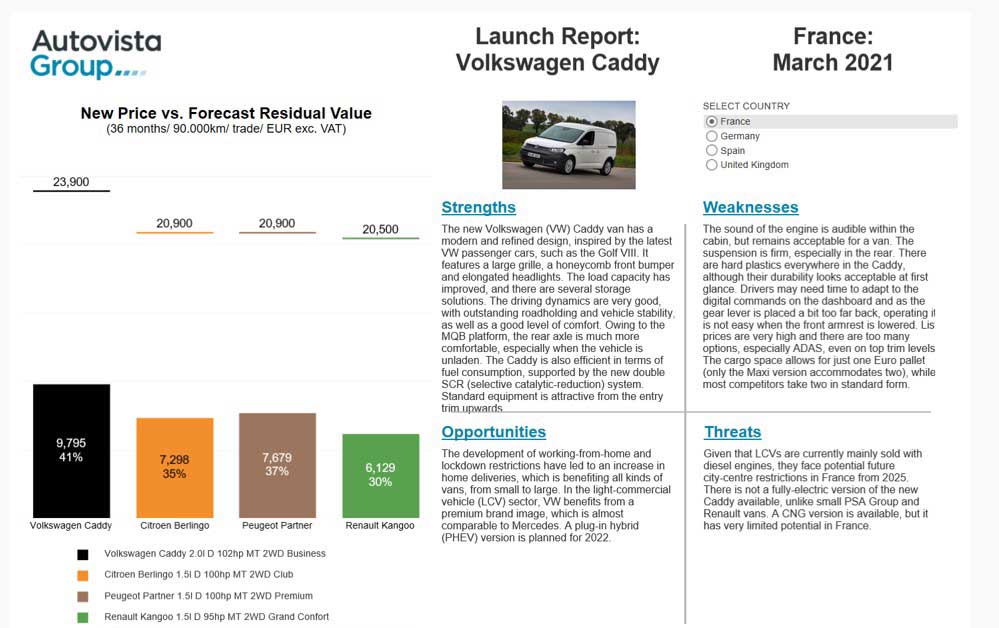

Launch Report: Volkswagen Caddy – improved engines and specifications

The Volkswagen (VW) Caddy has been redesigned from the ground up, with improved safety, space, engines, and advanced driver-assistance systems (ADAS). The fit and finish, digital cockpit, and general specification improvements make the model feel more like a VW passenger car. The driving dynamics are very good too, with outstanding roadholding and vehicle stability, as well as a good level of comfort.

Both the Caddy and the Caddy Maxi have grown in length and wheelbase, providing more cargo space. As the model is bigger, the maximum payload is slightly lower, but is the highest among key competitors. However, the loading volume of the Caddy is slightly below average, with the cargo space allowing for just one Euro pallet (only the long-wheelbase Maxi version accommodates two), while most competitors take two in standard form.

The new model hosts a comprehensive offer of assistance systems, including trailer-assist, which is a unique selling point in the segment. The modern interior and digital cockpit are advantageous for dual-use customers, i.e. drivers that use the vehicle for both commercial and private purposes.

The latest Euro 6 diesel engines benefit from huge emissions reductions and better fuel economy, supported by the new double SCR (selective catalytic-reduction) system. The 102-horsepower 2.0TDI has the lowest fuel consumption and CO2 emissions among its key rivals. There is not a fully-electric version of the new Caddy available, unlike small PSA Group and Renault vans. However, a plug-in hybrid (PHEV) version is planned for 2022. A compressed natural gas (CNG) version is already available in France, and will be available to order in Spain from December 2021.

The Caddy has a lower entry list price than its predecessor, but pricing is generally higher than those of other mainstream competitors. However, the fuel savings and reduced CO2 emissions will improve running costs and should entice new buyers. Furthermore, the development of working-from-home, and closures of non-essential retail, have led to an increase in home deliveries, benefiting demand for vans, and their residual values (RVs).

Click here or on the image below to read Autovista Group’s benchmarking of the VW Caddy in France, Germany, Spain and the UK. The interactive launch report presents new prices, forecast RVs and SWOT (strengths, weaknesses, opportunities and threats) analysis.

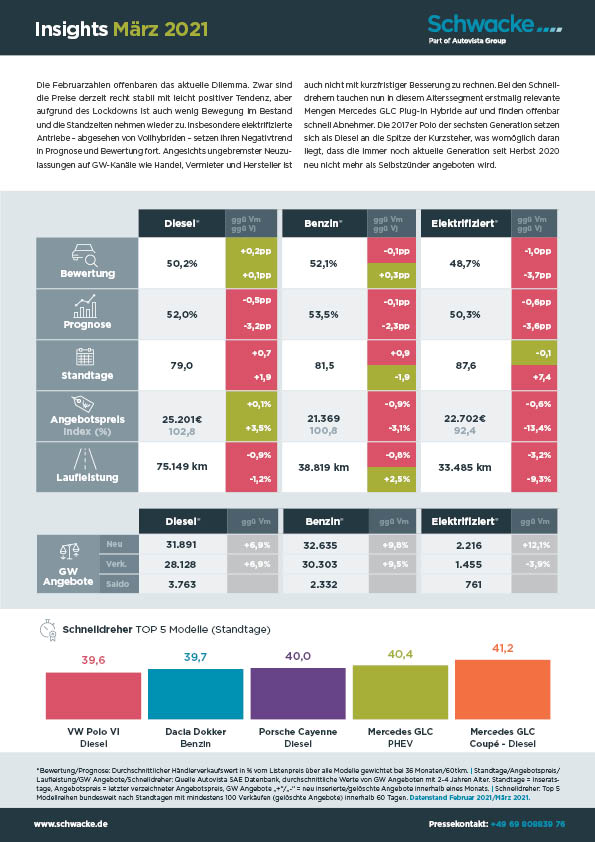

Schwacke Insights März 2021 – monatliche Kennzahlen im Überblick

Die Februarzahlen offenbaren das aktuelle Dilemma. Zwar sind die Preise derzeit recht stabil mit leicht positiver Tendenz, aber aufgrund des Lockdowns ist auch wenig Bewegung im Bestand und die Standzeiten nehmen wieder zu. Insbesondere elektrifizierte Antriebe – abgesehen von Vollhybriden – setzen ihren Negativtrend in Prognose und Bewertung fort. Angesichts ungebremster Neuzulassungen auf GW-Kanäle wie Handel, Vermieter und Hersteller ist auch nicht mit kurzfristiger Besserung zu rechnen. Bei den Schnelldrehern tauchen nun in diesem Alterssegment erstmalig relevante Mengen Mercedes GLC Plug-In Hybride auf und finden offenbar schnell Abnehmer. Die 2017er Polo der sechsten Generation setzen sich als Diesel an die Spitze der Kurzsteher, was womöglich daran liegt, dass die immer noch aktuelle Generation seit Herbst 2020 neu nicht mehr als Selbstzünder angeboten wird.

Video: Europe’s registrations struggle in February but improvements to come

Autovista Group Daily Brief editor Phil Curry discusses the registration figures from Europe’s big five automotive markets. While numbers may be down, the outlook for the whole year is more positive…

To get notifications for all the latest videos, you can subscribe for free to the Autovista Group Daily Brief YouTube channel.

Show notes

Lockdown drives German new-car registrations down by 19% in February

February UK new-car registrations plunge to level of 1959

Significant downturns in European registrations in February

Podcast: How is European automotive adapting to pandemic and climate-change fallout?

Daily Brief editor Phil Curry and journalist Tom Geggus discuss key activities and developments in the European automotive sector from the past fortnight. These include COVID-19’s effect on the uptake of mobility-as-a-service (MAAS), different fuel types, and autonomous technology.

Show notes

Cazoo buys Cluno as CaaS options increase

Significant downturns in European registrations in February

Lockdown drives German new-car registrations down by 19% in February

February UK new-car registrations plunge to level of 1959

VW accelerates towards electric and digital future

VW aims for commercialised autonomous systems in 2025

Is it too early to go ‘EV-only’?

Ford to be zero-emission capable in Europe by 2026

Jaguar makes BEV and hydrogen changes on path to net zero

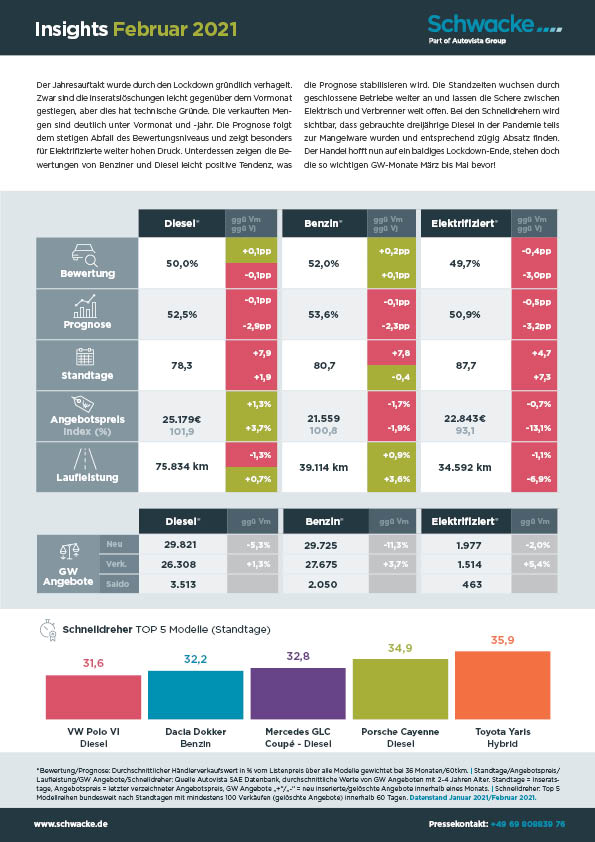

Schwacke Insights Februar 2021 – monatliche Kennzahlen im Überblick

Der Jahresauftakt wurde durch den Lockdown gründlich verhagelt. Zwar sind die Inseratslöschungen leicht gegenüber dem Vormonat gestiegen, aber dies hat technische Gründe. Die verkauften Mengen sind deutlich unter Vormonat und -jahr. Die Prognose folgt dem stetigen Abfall des Bewertungsniveaus und zeigt besonders für Elektrifizierte weiter hohen Druck. Unterdessen zeigen die Bewertungen von Benziner und Diesel leicht positive Tendenz, was die Prognose stabilisieren wird. Die Standzeiten wuchsen durch geschlossene Betriebe weiter an und lassen die Schere zwischen Elektrisch und Verbrenner weit offen. Bei den Schnelldrehern wird sichtbar, dass gebrauchte dreijährige Diesel in der Pandemie teils zur Mangelware wurden und entsprechend zügig Absatz finden. Der Handel hofft nun auf ein baldiges Lockdown-Ende, stehen doch die so wichtigen GW-Monate März bis Mai bevor!

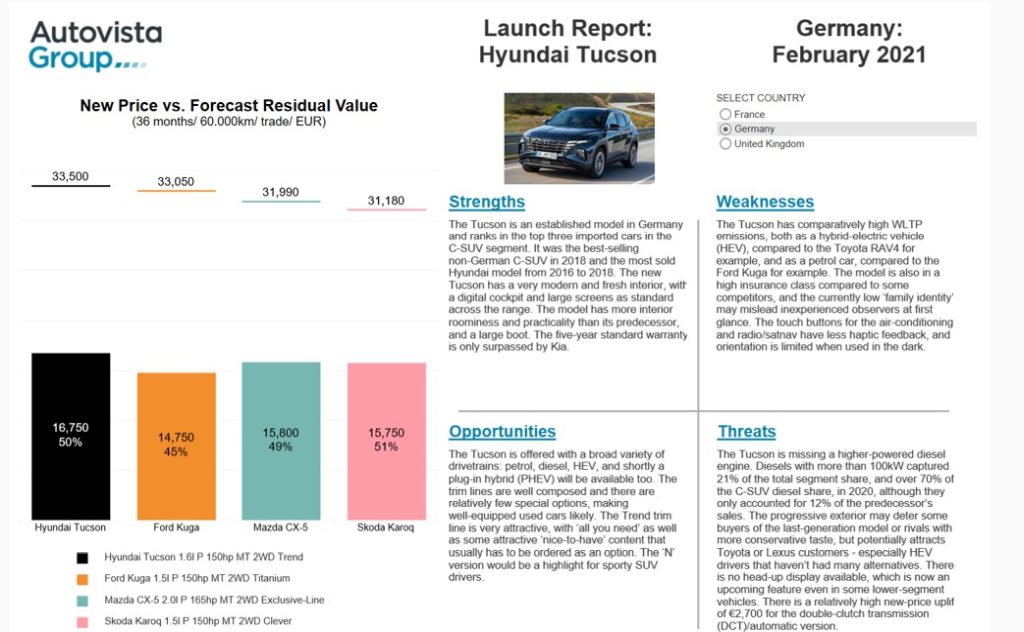

Launch Report: Hyundai Tucson – bolder and roomier

The new Hyundai Tucson has an assertive and bold design, with its front face combining the headlights and grille. The 3D rear-light signature echoes the progressive triangular headlight design and two-tone colour personalisation is now possible. As the new Tucson is longer and wider, it is roomier and more practical than its predecessor and has a large boot.

The modern and refined digital cockpit, featuring a flush-fitting 10-inch screen, is standard across the range and there is also a digital TFT screen directly in front of the driver. The materials, trim and build quality are all good and there are numerous ADAS and safety features, including a central airbag between the two front seats. A neat touch is the blind-spot monitoring system, which shows a digital feed from the left or right side of the car, depending on which direction is indicated.

The Tucson is offered with mild-hybrid (MHEV) petrol and diesel engines or as a full hybrid-electric vehicle (HEV), and a plug-in hybrid (PHEV) version will be available too. The trim lines are well composed and there are relatively few options, leading to well-equipped used cars.

With the leap forward in quality and roominess compared to its predecessor, the Tucson has the potential to attract a wider selection of consumers. The HEV version may present an attractive business proposition for buyers who are not yet ready to plug in.

Click here or on the image below to read Autovista Group’s benchmarking of the Hyundai Tucson in France, Germany and the UK. The interactive launch report presents new prices, forecast residual values and SWOT (strengths, weaknesses, opportunities and threats) analysis.

Germany: new-car registrations down 31% in January

New-car registrations fell by 31.1% in Germany during January compared with the same month in 2020. A total of 169,754 passenger cars were registered according to the latest figures from the country’s automotive authority, the Kraftfahrt-Bundesamt (KBA).

This aligns with the Autovista Group expectation of a return to year-on-year declines of about 30% in countries where dealers were closed for physical sales. Germany is the largest European market affected in January, with the restrictions currently in place until 14 February.

The German market was also hampered by the return to a 19% VAT rate since 1 January 2021, which had been reduced to 16% from 1 July to 31 December 2020. Autovista Group estimates that this change advanced about 40,000 new-car registrations into December 2020, when the market rose 9.9% compared to the previous reporting period. Furthermore, the shortage of semiconductors will have invariably disrupted some new cars’ deliveries in the country last month.

New-car registrations, Germany, y-o-y % change, January 2020 to January 2021

Source: KBA

There were two fewer working days in January 2021 than in January last year. On a comparable working-day basis, Autovista Group estimates that registrations fell by about 23% in the last month, and annualised new-car demand was at 2.94 million units. As in France, Spain and Italy, the start to 2021 of Germany’s new-car market has been deceptively shaky.

Given the mitigating factors in January, this bodes relatively well for the German market, which Autovista Group currently forecasts will recover to 3.15 million units in 2021, 8% up on 2020. This is at the same level as the German automotive industry association VDA forecasts. However, the VDA rightly highlighted that 2021 will still be ‘significantly lower than the approximately 3.5 million new registrations of the years 2017 to 2019.’

‘We assume that the second half of 2021 will bring an improvement, if the progress in vaccination is so great that the pandemic can be noticeably contained in everyday life,’ commented VDA president Hildegard Müller. This echoes the EU-wide sentiment expressed by the European Automobile Manufacturers’ Association (ACEA). ‘The year 2021 will decide the future of the industry in Germany and Europe. We are at a turning point that will set the direction for the following decades,’ Müller added.

Brands and segments

German brands reflected January’s negative performance. Audi (down 47.4%), Mini (down 41.5%), and Ford (down 41.1%) saw the most significant declines. Meanwhile, Porsche posted the smallest losses, with a drop of 3.9%. Volkswagen maintained the largest market share, of 20.1%.

Among the imported brands, Tesla and Volvo exceeded their registration results for the same reporting period in 2020, up 23.4% and 9.4% respectively. In contrast, declines of more than 70% were seen at Jaguar and Honda (down 77.9% and 70.1% respectively), while Fiat recorded the smallest decrease of 14.8%. Skoda was the strongest imported brand for market share, with 6.7% of registrations.

Motorhomes were the only segment to achieve growth, of 5%, to capture a market share of 1.9%. Meanwhile, small MPVs saw the most severe decline at 63.6%, and full-size MPVs fell 55.3%, sports cars slumped by 43.2% and utility vehicles dropped by 42%. SUVs were the strongest segment with 21.9% of the market, despite a decrease of 26.4%, followed by the compact segment with a 19.1% share, down 32.2%.

Fuel types

Registrations of petrol-powered cars fell by half (50.3%) in January 2021 compared to the previous reporting period, taking 37.1% of the market. Diesel also dropped by 44.8%, representing just over a quarter of new cars (26.1%). In contrast, electrically-chargeable vehicles (EVs) saw year-on-year growth of 117.8%, with a total of 16,315 new units registered, taking their share to 9.6%.

Some 45,449 hybrids were registered in January, up 47.5%, while securing 26.8% of the market. A total of 20,588 plug-in hybrid units were registered in January, up 138.3%, with a 12.1% share. Natural gas (259) and liquefied gas (340) only accounted for 0.2% of the market last month, recording a combined decrease of 35.5%. The average CO2 emissions of newly registered cars was 125.9 g/km, representing a decrease of 16.9%.

The tipping balance towards EVs, and away from internal combustion engines (ICE), follows on from a trend recorded last year. In 2020, alternative drives made up of hybrid, fuel-cell, gas, hydrogen, and battery-electric vehicles (BEVs), claimed approximately a quarter of all new-car registrations. The German government set out COVID-19 recovery plans as a springboard towards a greener economy, with a greater emphasis on electromobility. In November, it committed a €4 billion stimulus package to the automotive sector, with funds channelled into the adaptation of production lines and incentivising the purchase of EVs.

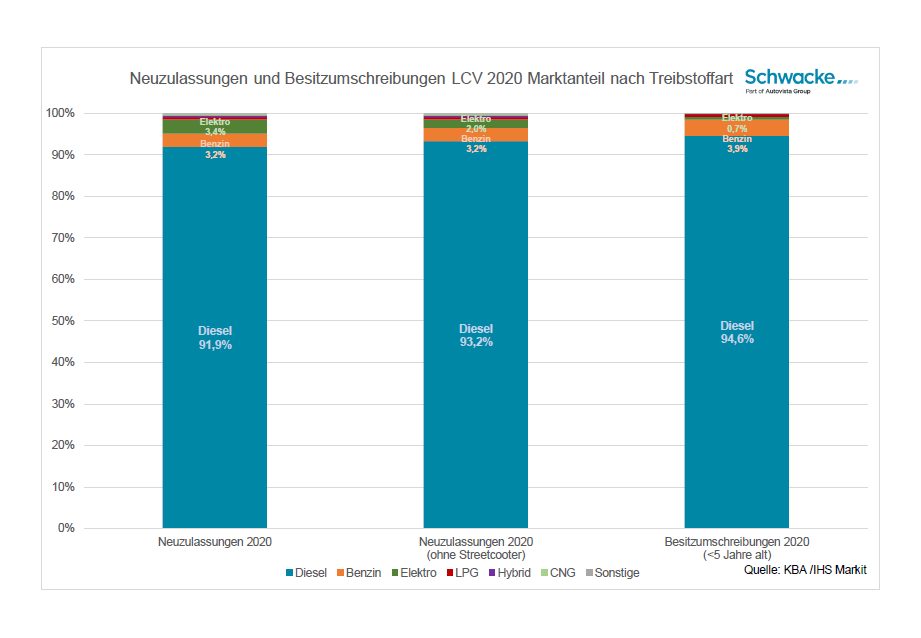

Letzte Meile – Wie sind die Aussichten für emissionsarme Transporter?

Die Elektrifizierung des Neuwagenmarktes schreitet mit großen Schritten voran. 2020 war trotz Krise bei den e-PKW ein außergewöhnliches Boomjahr. Knapp 6,7 % Marktanteil erzielten reinelektrische Modelle und die Plug-Ins konnten weitere 6,9 % Marktanteil erzielen. Vor allem die staatliche Innovationsprämie hat zu einem Zulassungsrausch geführt, der gegenüber dem Vorjahr die Zahlen für pure Stromer verdreifachte und die Steckerhybride sogar auf das Viereinhalbfache katapultierte!

Da die Innovationsprämie auch für leichte Nutzfahrzeuge gilt, liegt die Frage nahe, ob es bei den Lastenträgern ähnlich aussieht. Die nüchterne Antwort ist schlichtweg: Bei Weitem nicht! Dabei wären gerade die klassischen „Letzte Meile“-Einsätze, also häufige Innenstadtfahrten sowie teils geringe Jahreslaufleistungen und Fahrstrecken geradezu prädestiniert für emissionslose Elektromobilität.

Die Gründe für die bisherige Zurückhaltung sind vielfältig: Zunächst einmal ist die Angebotspalette an Modellen deutlich geringer als bei den PKW. Die Hersteller sind hier mit der Entwicklung alltagstauglicher Transporter, die eine angemessene Balance von Batteriegewicht versus Nutzlast und Frachtraum sowie einen bezahlbaren Listenpreis bieten, recht spät dran. Zu erklären ist das nicht zuletzt mit den vergleichsweise geringen Gesamt-Stückzahlen, die kostenintensive technische Neuentwicklungen behindern. Das weit verbreitete Rebadging technisch gleicher Baureihen mit unterschiedlichen Markenemblemen scheint hier die Not nicht gemindertt zu haben, insgesamt erzeugt der Transportermarkt nicht mal ein Zehntel der PKW-Zulassungen. Da traut sich bisher nur VW mit dem ID.Buzz oder dem MOIA-Gefährt und eben die Deutsche Post-Tochter Streetscooter an komplette Neuentwicklungen. Die übrigen beschränken sich auf Umbauten bestehender Modellreihen.

Nun aber kommen dennoch zunehmend weitere E-Varianten auf den Markt und längst ist es auch möglich, einen Kastenwagen in Sprintergröße geräuschlos zu bewegen. Die medial und im Straßenbild mittlerweile allgegenwärtigen Streetscooter machten dabei 2020 von den 3,4% reinelektrischen Zulassungsanteil über 40% aus und stellen alleine 1,4% des Gesamtmarktes. Im Gebrauchtmarkt liegt der Anteil bei noch enttäuschenderen 0,7% für die bis zu 5jährigen (Abb. 1). Vor allem weil die mittlerweile über 17.000 in den letzten Jahren zugelassenen Streetscooter fast ausschließlich bei Deutsche Post/DHL betrieben werden und gar nicht mehr in der Wiedervermarktung auftauchen – gerade mal 63 seit Produktionsbeginn. Nach verlustreichen Jahren wird bald auch die Neuproduktion eingestellt.

Doch trotz der zunehmenden Verfügbarkeit von Modellen und staatlicher Prämien kam der Verkauf letztes Jahr nicht so richtig in Schwung. Woran liegt das? Letztendlich sind Nutzfahrzeuge Arbeitsmittel und werden entsprechend penibel kostenseitig und preissensitiv betrachtet. Im Transporterbereich zählt da eben nicht nur der Kaufpreis oder die Leasingrate, sondern auch Betriebskosten und ein möglichst risikoarmer Betrieb. Angesichts der relativ hohen Haushaltsstrompreise in Deutschland ist es bei einem Kleintransporter nicht wirklich günstiger als einen vergleichbaren Diesel zu befeuern. Von teils höheren Strompreisen an öffentlichen Ladesäulen ganz zu schweigen. Dazu kommt eine sehr vorteilhafte deutsche Kfz-Steuer, die der Steuerbefreiung von Stromern auch keinen merklichen Jahresbetrag für Verbrenner entgegenstellt. Und nicht zuletzt fallen Unsicherheiten bei potenziellen Kunden ins Gewicht, die einen reibungslosen Einsatz beeinträchtigen könnten. Finden meine Fahrer eine Ladesäule, wenn sie unterwegs eine benötigen, welche Bezahlsysteme brauche ich, wie kalkuliere ich die Ausfallzeit ein, bekomme ich ein adäquates Ersatzfahrzeug, passt mein L4 auf den öffentlichen Ladesäulenplatz? etc.

Sicher, für all das gibt es Antworten und Lösungen, aber Betreiber von Nutzfahrzeugen haben mit ihrem Daily Business genug zu tun, dass sie sich offenbar scheuen, jedwedes Risiko einzugehen, solange es nicht nötig ist und setzen auf Bewährtes. Die Vorteilsargumentation beispielsweise in geringeren Wartungskosten und Verschleiß ist komplex und kommt bei Gebrauchtkäufern noch nicht richtig an. Einen weiteren Kaufanreiz könnten vermutlich nur eine stärkere Subventionierung der Betriebskosten z.B. durch günstigen Strom und entsprechend verbesserte öffentliche Ladeinfrastruktur oder – wie in anderen Ländern – als Negativmotivation Fahrverbote für Innenstädte bieten. Beides ist aktuell nicht in Sicht, sodass bei den Nutzis erst noch der Knoten platzen muss. Neu und vor allem mit einem Konzept für Kaufanreize der noch preissensibleren Gebrauchtkäufer. Da der Transportermarkt auf absehbare Zeit weiter wachsen wird, eine lohnende Investition, aber noch ein weiter Weg.

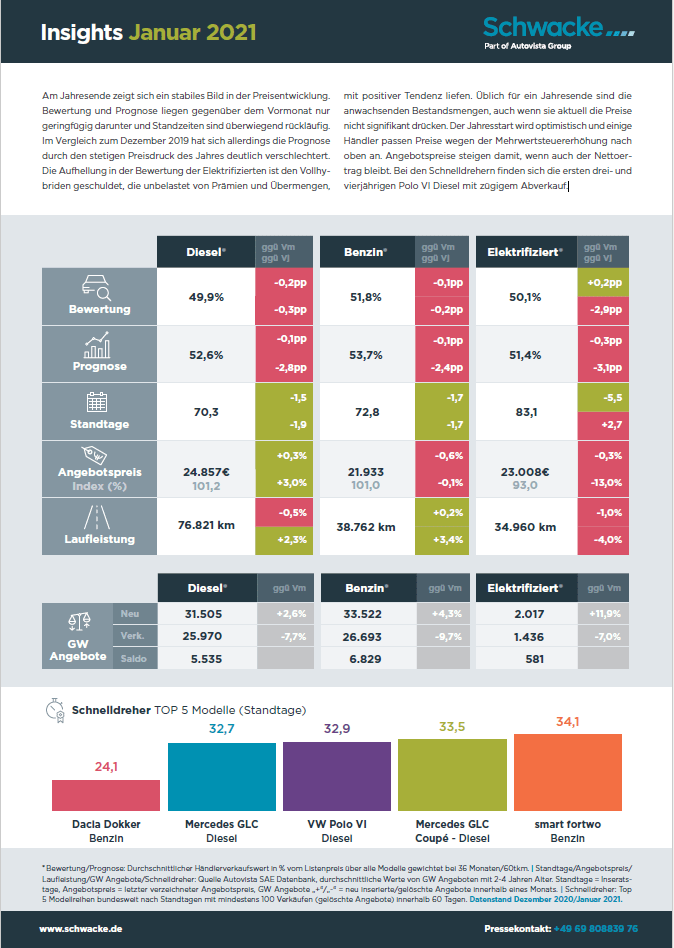

Schwacke Insights Januar 2021 – monatliche Kennzahlen im Überblick

Am Jahresende zeigt sich ein stabiles Bild in der Preisentwicklung. Bewertung und Prognose liegen gegenüber dem Vormonat nur geringfügig darunter und Standzeiten sind überwiegend rückläufig. Im Vergleich zum Dezember 2019 hat sich allerdings die Prognose durch den stetigen Preisdruck des Jahres deutlich verschlechtert. Die Aufhellung in der Bewertung der Elektrifizierten ist den Vollhybriden geschuldet, die unbelastet von Prämien und Übermengen, mit positiver Tendenz liefen. Üblich für ein Jahresende sind die anwachsenden Bestandsmengen, auch wenn sie aktuell die Preise nicht signifikant drücken. Der Jahresstart wird optimistisch und einige Händler passen Preise wegen der Mehrwertsteuererhöhung nach oben an. Angebotspreise steigen damit, wenn auch der Nettoertrag bleibt. Bei den Schnelldrehern finden sich die ersten drei- und vierjährigen Polo VI Diesel mit zügigem Abverkauf.

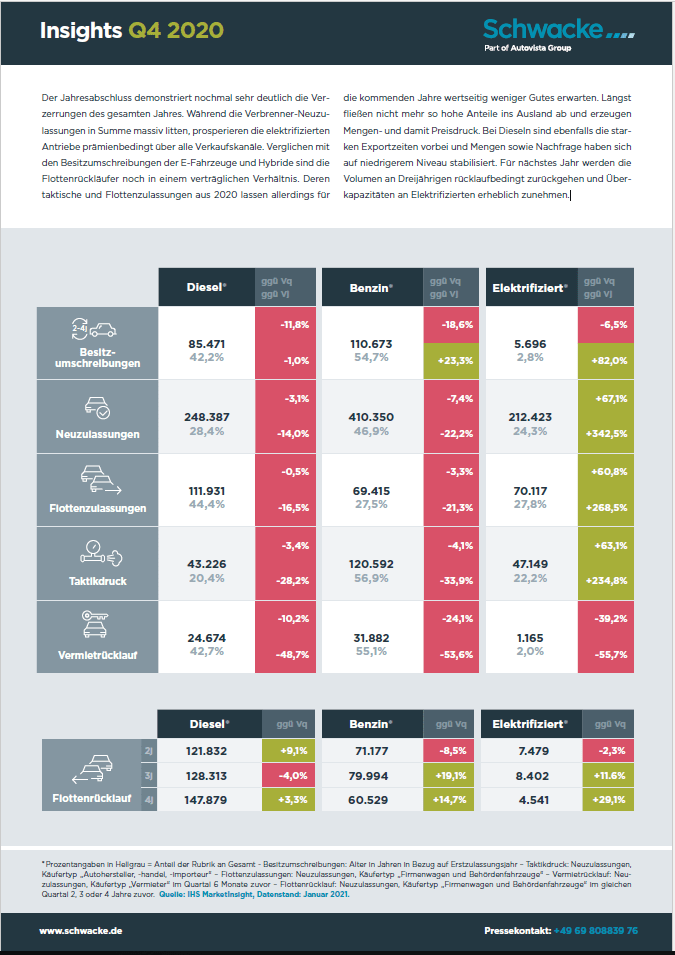

Schwacke Insights Q4 2020 – Zulassungen aus Restwertsicht

Der Jahresabschluss demonstriert nochmal sehr deutlich die Verzerrungen des gesamten Jahres. Während die Verbrenner Neuzulassungen in Summe massiv litten, prosperieren die elektrifizierten Antriebe prämienbedingt über alle Verkaufskanäle. Verglichen mit den Besitzumschreibungen der E-Fahrzeuge und Hybride sind die Flottenrückläufer noch in einem verträglichen Verhältnis. Deren taktische und Flottenzulassungen aus 2020 lassen allerdings für die kommenden Jahre wertseitig weniger Gutes erwarten. Längst fließen nicht mehr so hohe Anteile ins Ausland ab und erzeugen Mengen- und damit Preisdruck. Bei Dieseln sind ebenfalls die starken Exportzeiten vorbei und Mengen sowie Nachfrage haben sich auf niedrigerem Niveau stabilisiert. Für nächstes Jahr werden die Volumen an Dreijährigen rücklaufbedingt zurückgehen und Überkapazitäten an Elektrifizierten erheblich zunehmen.

Schwacke Newcomer Januar 2021 – Neue Modelle im Forecast

Kompakte Hingucker – Fernost und -west

Im Januar haben wir wieder Restwertprognosen für interessante Fahrzeugneuerscheinungen in unsere Datenbank aufgenommen:

- Cadillac XT4

- Hyundai Tucson

Cadillac XT4 – Junior Manager

Mit dem Namen Cadillac verbinden die meisten Deutschen entweder Staatskarossen oder übergroße SUV wie den Escalade. Mit dem XT4 kommt in Europa ein dahingehend höchst ungewöhnlicher Amerikaner auf den Markt. Zum einen ist er für Cadillac-Verhältnisse klein. Bei einem Radstand von fast 2,80m und einer Länge von ca. 4,60m liegt er ungefähr zwischen einem Audi Q3 und Q5. Wer dazu noch bei der Bezeichnung 350D oder 350T auf einen Sechszylinder jenseits der Dreiliter-Marke hofft, wird ebenfalls enttäuscht. Ausschließlich „unamerikanische“ Vierzylinder mit 174 bzw. beim Benziner 230PS treiben das in Kansas City gebauten GM-Modell an. Optisch ist er allerdings im immer stärkerer besetzten SUV-Markt ein Hingucker für Fahrer, die aus der Masse herausstechen möchten. Auch preislich wird der Caddy zur Alternative. Das Topmodell endet preislich dort, wo manch Wettbewerber erst anfängt und vollausgestattet ist er immer noch erschwinglich. Dennoch wurden im vergangenen Jahr gerade mal 36 XT4 zugelassen. Angesichts der Tatsache, dass dieses Modell in 2020 neben 6 Escalades das einzige Modell war, dass es in die Zulassungsstellen schaffte, sicher für den Handel ein herber Schlag. Das größte Manko dürften Motor und Interieur sein. Beim Antrieb fehlen zeitgemäße Leistungs- und Verbrauchsdaten. Ohne Mildhybrid-Unterstützung oder alternative Antriebsform stehen die Zweiliter-Turbomotoren weder für Ökologie noch für Ökonomie. Zudem tun sich die beiden Verbrenner buchstäblich schwer mit dem XT4. Die Innenausstattung ist üppig und technisch ausreichend, wirkt aber für ein brandneues Modell nicht auf dem allerneusten Stand der Zeit. Wenn man sich beispielsweise die Kombination aus analogem und digitalem Instrumentenblock oder das relativ kleine 8 Zoll Touchdisplay anschaut, wähnt man sich eher in einem Segment darunter. Dennoch lohnt sich die Anfrage bei einem der 14 deutschen Cadillac-Händler, wenn man gerne in einem Fahrzeug abseits des Mainstreams zu einem erschwinglichen Preis sitzt und über kleine Materialschwächen hinwegsehen kann. Dafür bekommt man viel Auto und manch attraktives Feature, wie die optionale Innenspiegelkamera.

Hyundai Tucson – Captain Future

Der Tucson – gesprochen ohne das „c“ mit verlängertem „u“ und scharfem „s“ – war von 2016 bis 2019 der meistzugelassene Hyundai in Deutschland. Entsprechend viel Aufmerksamkeit widmeten die Entwickler dem Nachfolger des gar nicht mal so alt aussehenden, erfolgreichen Vorgängers. Auf den ersten Blick überrascht die futuristische Optik. Bisher war der Koreaner ein moderner asiatischer Vertreter der SUV-Zunft, zeigt aber in der vierten Generation schon fast Concept Car Allüren. Am stärksten fällt die Frontpartie ins Auge, die mit dem Grill Design-Maßstäbe setzt. Zumindest in der aktuellen Hyundai-Modellpalette fällt er damit ein wenig aus dem Rahmen und lässt selbst neue Geschwister wie den kürzlich eingeführten i30 alt aussehen. Womöglich werden die ersten Exemplare auf den Straßen sogar eher für einen Toyota oder Lexus gehalten. Innen setzt sich die Modernität fort, bleibt aber eher gediegen als überzeichnet. Große Digitaldisplays und wertige Materialien werden auch in drei Jahren als Gebrauchter noch Kunden frisch erscheinen. Die Preise bewegen sich im Mittelfeld und werden zusätzlich zu gut ausgestatteten Ausstattungslinien durch eine überschaubare Aufpreisliste ergänzt. Die Optionen und Pakete passen – mittlerweile Hyundai-typisch – auf eine Preislistenseite. Mit der Trendausstattung werden vermutlich die meisten Neu- wie Gebrauchtkunden versorgt werden und machen damit einen guten Fang. Zu kritisieren gibt es wenig, wenn man von der vielleicht für Manchen gewöhnungsbedürftigen Optik absieht. Einzig die Verbrauchswerte der Motoren liegen etwas über dem Durchschnitt, was bei hiesigen moderaten Kfz-Steuern und Treibstoffen aber weniger ins Gewicht fallen dürfte. 5 Jahre Garantie sind da bei einem Dreijährigen vermutlich das stärkere Argument.

Schließen

Schließen