The Brexit deal has offered some relief to UK manufacturers of electrically-chargeable vehicles (EVs) following earlier reports that tariffs would be applied to exported vehicles that do not contain a certain quota of ‘locally-sourced’ components.

During negotiations, issues surrounding the number of components used in vehicles from outside Europe came to light. This problem especially affected EVs, where all pieces of the battery count as components and many of which are sourced from Asia.

Without a certain number of locally-sourced parts, vehicles would be subject to tariffs under World Trade Organisation rules, meaning EVs could see an additional 10% added to UK exports to the continent. For the purposes of any deal, locally sourced would mean components produced within the European Union and/or the UK.

In October 2020, this issue was reported as a sticking point in negotiations, with components from Japan and Turkey highlighted as being unable to count as locally sourced, despite the UK negotiating free-trade agreements with both countries. Manufacturers with plants based in the UK and the EU will need to prove that exported goods are European-made, with a specified threshold of parts, a move known as ‘cumulation’.

Battery threshold

The Brexit trade deal offers carmakers a slender lifeline, with a staggered transition period of three and six years. In this time, the number of locally-sourced components must increase; otherwise, tariffs will be introduced, in spite of a free-trade agreement.

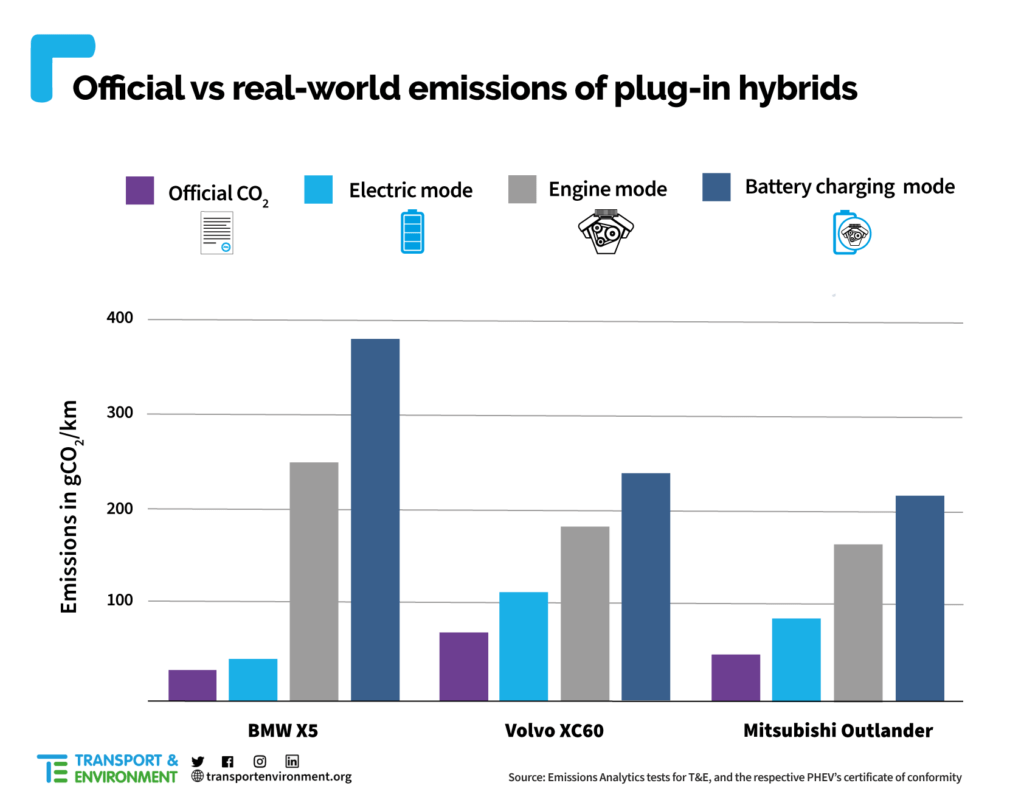

Up until 31 December 2023, Annex Orig-2B: Transitional product-specific rules for electric accumulators and electrified vehicles, states that accumulators and battery cells must either be produced in the EU or comprise no more than 70% non-EU components before tariffs are introduced. Hybrid, plug-in hybrid (PHEV) and battery-electric vehicles (BEVs) can comprise no more than 60% non-EU or UK components.

However, following this period, a further stage has been included, whereby the threshold of non-local parts drops, with accumulators only allowed to feature a maximum 40% foreign components, battery cells 50% and hybrids, PHEVs and BEVs a limit of 55%, until 31 December 2026.

The rules for 2027 and beyond will be reviewed later, but not before 2025 after the first transition period has passed.

‘The review shall be done on the basis of available information about the markets within the parties, such as the availability of sufficient and suitable originating materials, the balance between supply and demand and other relevant information,’ the document states.

Sourcing components

The parts requirement could have a significant impact on automotive manufacturing in the UK, particularly in terms of where components are sourced. Currently, Toyota builds hybrid models in the country, while Nissan produces its BEV Leaf model for export to Europe. Other carmakers are also developing their UK lines for electrification, with BMW preparing to build the Mini Electric, and Jaguar Land Rover retooling their plants for upcoming models.

The terms of the deal mean that carmakers must find as many locally-sourced components as possible for EVs and hybrids to be built in the UK. Failure to adhere to the thresholds as laid out in the UK-EU deal will mean vehicles built in Britain will have a 10% tariff added when they are shipped. This will likely make them uncompetitive on the European market, impacting sales as a result.

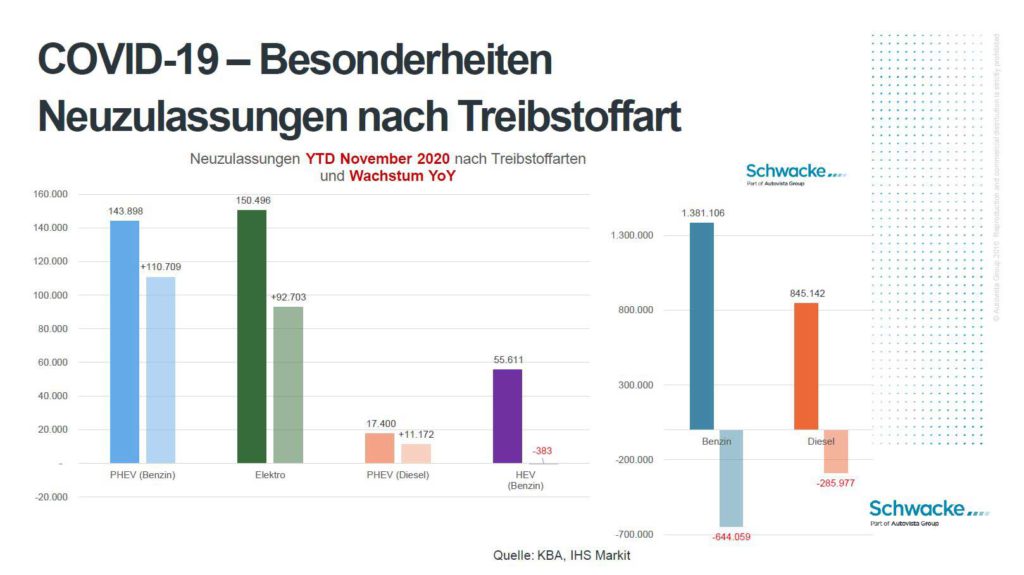

The automotive industry is increasingly moving away from internal combustion engines (ICE) as CO2 targets mean zero-emission technology is the only way to meet mandates. Yet the supply of crucial components related to the battery and motors is dominated by companies and plants based in Asia, which do not count as locally sourced.

There is, however, an increasing drive for battery manufacturing in Europe, with several companies announcing the building of gigafactories on the continent. There is also a project to develop batteries in the UK, adding to the available local components‘ roster. Many of these aim to be fully up and running by the middle of the decade, with production starting slowly in the next couple of years. This could represent a realistic opportunity of meeting both threshold targets.

Free trade

However, the complexities of trade agreements could also prove difficult to UK vehicle manufacturing. Japanese newspaper Nikkei reported that Nissan had chosen not to produce its upcoming electric Ariya SUV at its Sunderland plant, which is already tooled for production thanks to its manufacturing of the Leaf. Instead, the company will produce the vehicle in Japan and take advantage of free-trade deals with the EU and the UK to export the vehicle to these markets. However, Nissan has stated that it had no plans to produce the Ariya in the UK at all, according to Automotive News Europe.

These trade agreements could see other EV developments pulled out of the UK, while some European-based manufacturers may already be considering moving production of PHEVs and BEVs out of the country in case they cannot meet the first threshold deadline in 2024.

Schließen

Schließen