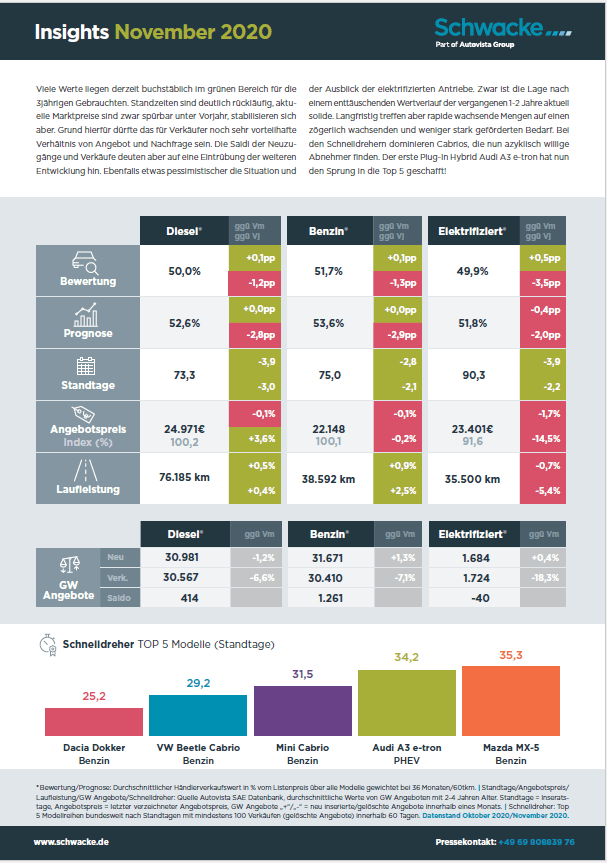

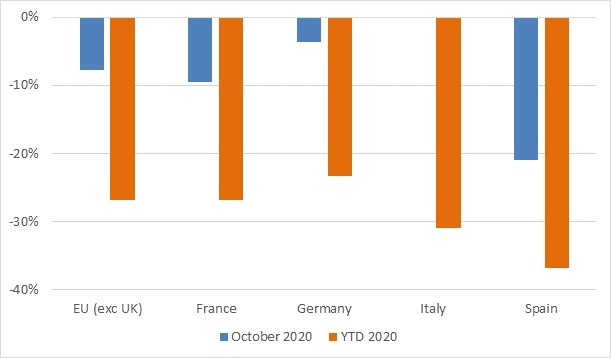

Germany saw the registration of 2.9 million new cars in 2020, down 19.1% on 2019. The latest figures from the Kraftfahrt-Bundesamt (KBA) show that 62.8% of these units were registered for commercial purposes, down 22.4%, while 37.1% of the market share was private, down 13%.

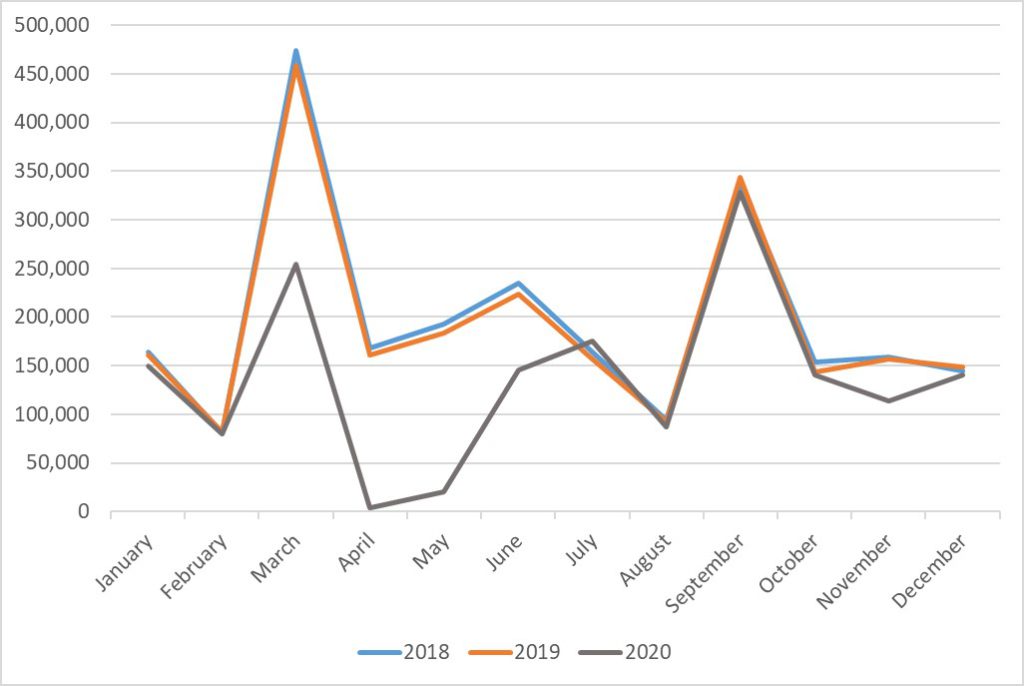

Bidding farewell to a year of unprecedented challenges, the German market was able to end 2020 on a marginally positive note. A total of 311,394 passenger cars were sold in December last year, up 9.9% on the same period from 2019. Accompanied by an 8.4% rise in September, the German new-car market only saw two months of registration growth in 2020. These upticks in the second half of last year represent a move away from the 61% plunge in April and 49.5% drop in May.

New-car registrations, Germany, y-o-y % change, January to December 2020

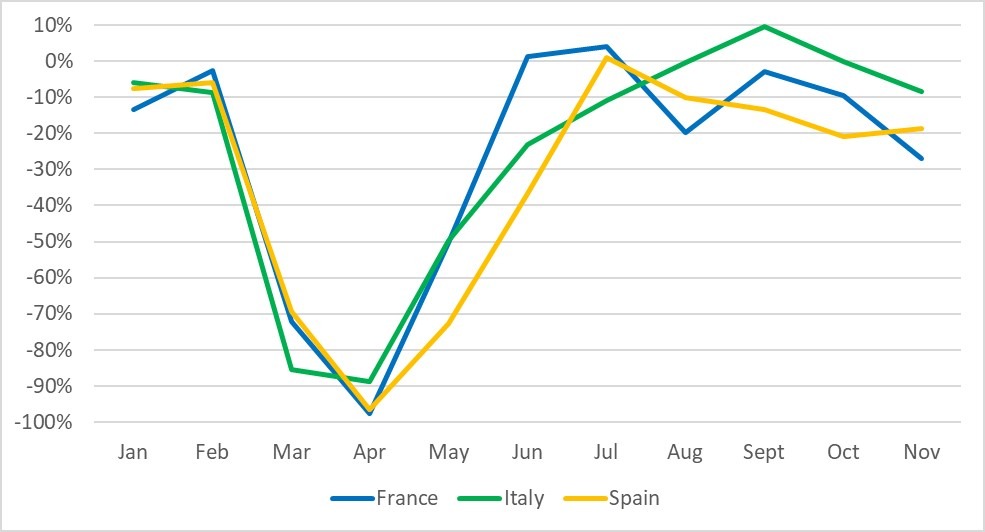

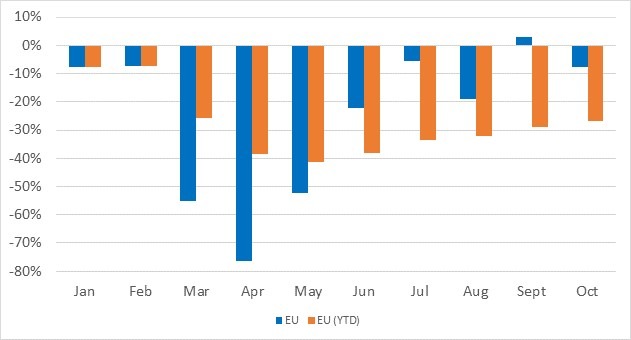

While Germany appears to be leading the way with a recovering automotive market, difficulties continue across Europe as member states are battered by fresh pandemic waves. In December last year, French new-car registrations dropped by 11.8% compared to the same period in 2019. Italy felt a greater decline at 14.9%, while Spain saw just 13 fewer registered units than December 2019. However, Germany does not appear to be out of the woods yet.

Climbing infection rates have triggered an extension of the country’s lockdown measures until the end of January. This makes a positive start to this year seem even less likely as dealerships must remain closed, except for the service departments. While Autovista Group’s Schwacke expects to see a recovery to just under 3.1 million new-car registrations in 2021, it predicts figures will be below those in previous years, and significantly below 2019’s peak.

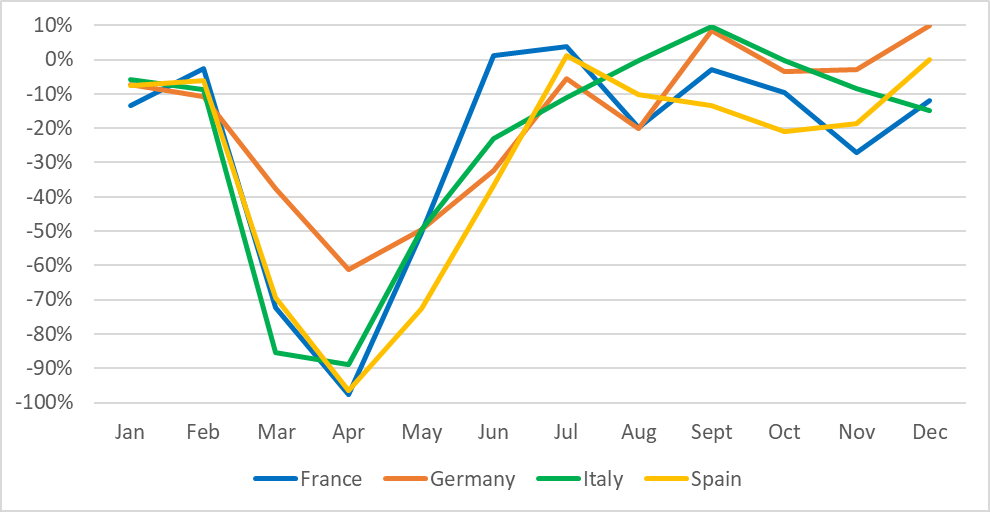

New-car registrations, EU4, y-o-y % change, January to December 2020

Data: CCFA, KBA, ANFIA, ANFAC

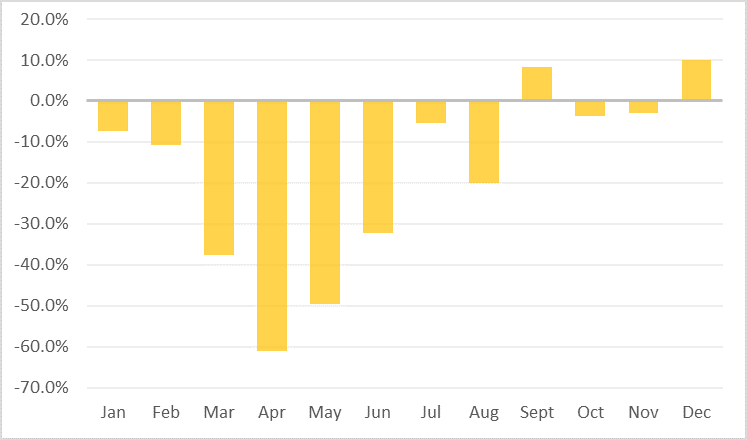

Drives and segments

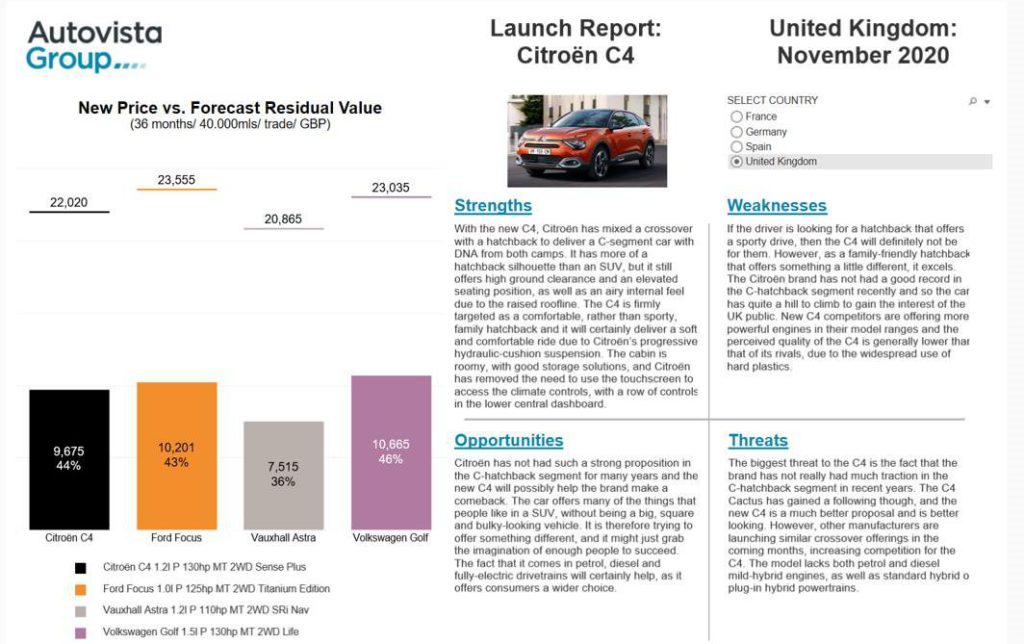

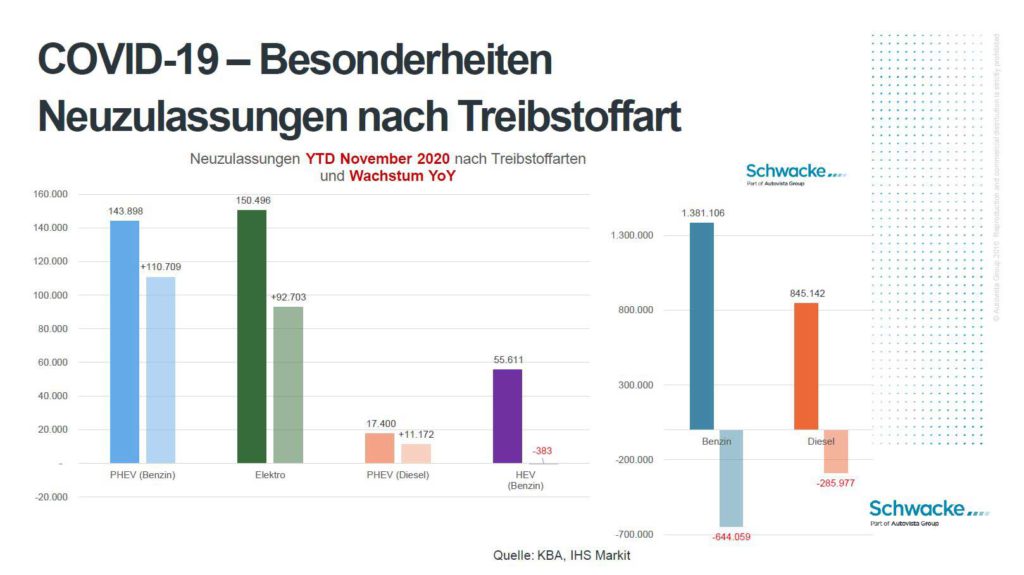

With the largest share of last year’s market at 46.7%, a total of 1,361,723 petrol-powered cars were registered, down 36.3% on 2019. Meanwhile, 819,896 diesel-driven cars took a 28.1% share, down 28.9% on the previous year.

Alternative drives, consisting of hybrids, battery-electric vehicles (BEVs), hydrogen fuel-cell and gas claimed approximately a quarter of all new-car registrations in Germany last year. Hybrids achieved a share of 18.1%, up 120.6% on the previous period with 527,864 registrations, including plug-in hybrids (PHEVs) with 200,469 units, up 342.1% and with a market share of 6.9%. Electric cars represented 6.7% of the market, up 206.8% to 194,163 units. A total of 7,159 gas-powered cars were registered in 2020, down 6.1% on 2019, and LPG-driven cars saw a drop of 9.8%, to 6,543 units. CO2 emissions from cars fell by 11.0% last year, on average to 139.8g/km from 157.0g/km in the previous reporting period.

Over half of all registrations were accounted for by SUVs (21.3%), compact cars (20.5%) or small cars (15.1%). With 2.6% of the market, motorhomes saw the most significant increase, up 41.4%.

Brand performance

All German brands showed a decline last year. Smart took the hardest fall at 67.3%, followed by Opel, which dropped by 32.3%, then Ford down 30.6%. VW fell by 21.3% on the previous reporting year, Audi slumped by 19.9%, Porsche was down by 16.3%, BMW dropped by 13.7%. Negative results were also reported by Mini (down 11.7%) and Mercedes (down 10.6%). With a share of 18%, VW held the largest share of the new-car market in 2020.

For imported brands, both Tesla (up 55.9%) and Fiat (up 0.2%) reported positive results for 2020. Meanwhile, declines were recorded by Suzuki (down 44.8%), Ssangyoung (down 40.2%), Mazda (down 38.1%) and Dacia (down 36.6%). Skoda led the imported brands with a market share of 6.2%, followed by Renault with 4.3%.

Schließen

Schließen