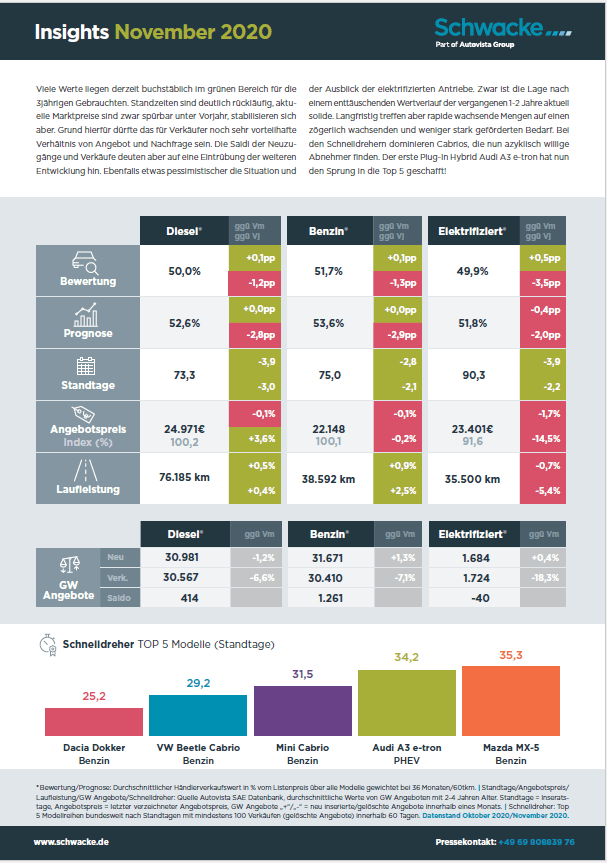

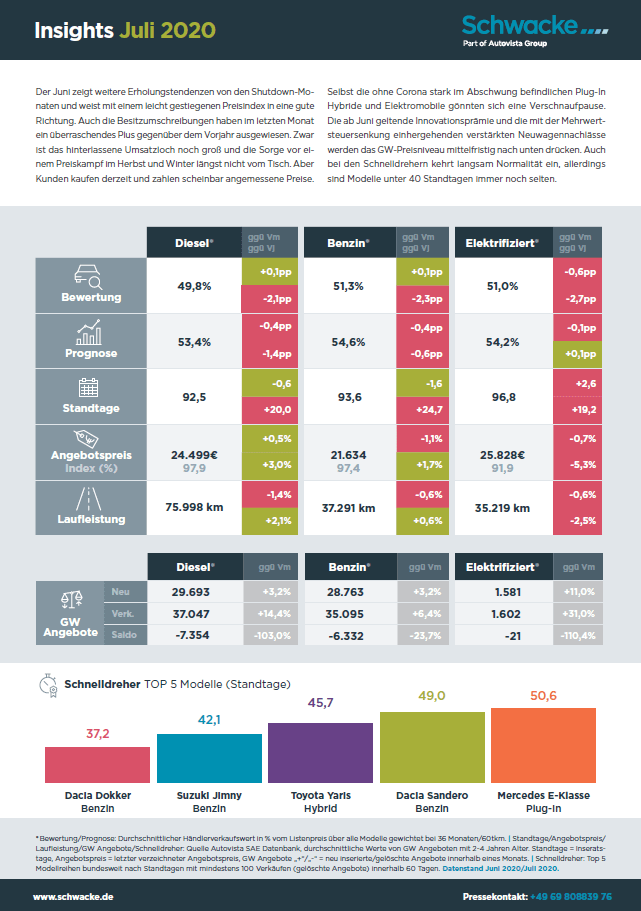

Viele Werte liegen derzeit buchstäblich im grünen Bereich für die 3jährigen Gebrauchten. Standzeiten sind deutlich rückläufig, aktuelle Marktpreise sind zwar spürbar unter Vorjahr, stabilisieren sich aber. Grund hierfür dürfte das für Verkäufer noch sehr vorteilhafte Verhältnis von Angebot und Nachfrage sein. Die Saldi der Neuzugänge und Verkäufe deuten aber auf eine Eintrübung der weiteren Entwicklung hin. Ebenfalls etwas pessimistischer die Situation und der Ausblick der elektrifizierten Antriebe. Zwar ist die Lage nach einem enttäuschenden Wertverlauf der vergangenen 1-2 Jahre aktuell solide. Langfristig treffen aber rapide wachsende Mengen auf einen zögerlich wachsenden und weniger stark geförderten Bedarf. Bei den Schnelldrehern dominieren Cabrios, die nun azyklisch willige Abnehmer finden. Der erste Plug-In Hybrid Audi A3 e-tron hat nun den Sprung in die Top 5 geschafft!

Schließen

Schließen