New Vehicles

New Vehicles

EU new-car market falls with double-digit BEV decline

22 April 2024

New Vehicles

New Vehicles

How did Europe’s big five new-car markets perform in the first quarter?

19 April 2024

Tech

Tech

BYD stays at top of Chinese EV market while Aito and Wuling enjoy success

18 April 2024

Tech

Tech

How important are BEV battery health certificates?

17 April 2024

What is?

View more sustainability

sustainability

What is the UK ZEV mandate?

28 March 2024

New Vehicles

New Vehicles

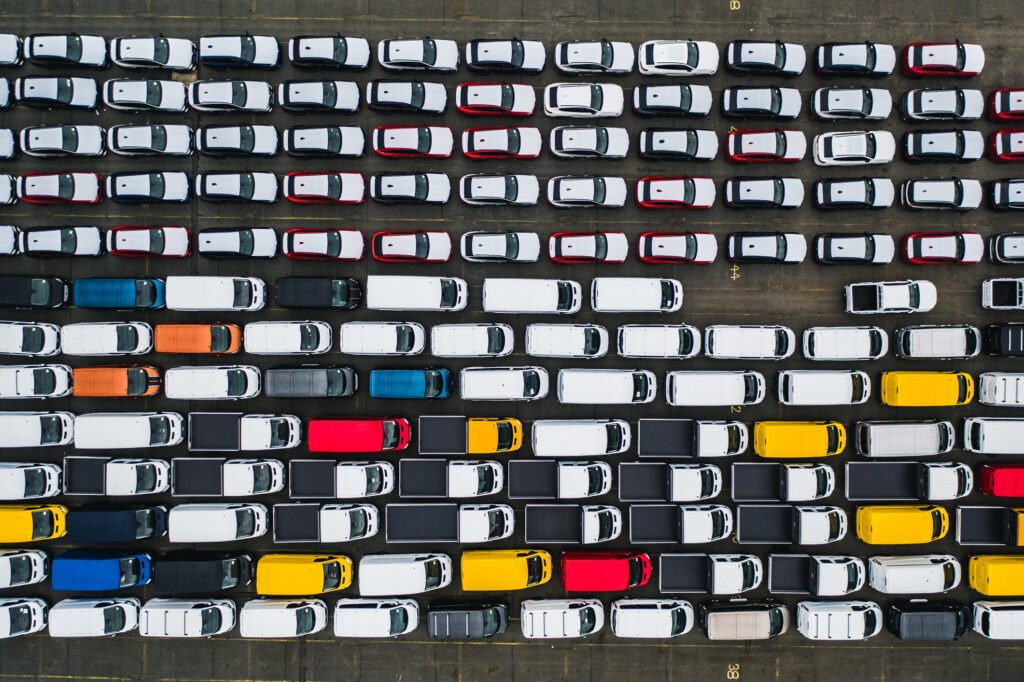

How important is vehicle registration data?

27 February 2024

sustainability

sustainability

How have Euro 7 emission standards changed?

30 January 2024

Companies

Companies

What is a hydrogen fuel-cell vehicle?

23 October 2023

Tech

Tech

Why Rules of Origin is causing problems for Europe’s automotive market

26 July 2023

Launch Reports

View more New Vehicles

New Vehicles

Launch Report: Peugeot 3008 offers quality and style with bold design

10 April 2024

New Vehicles

New Vehicles

Launch Report: Volvo EX30 presents premium B-SUV package

14 March 2024

New Vehicles

New Vehicles

Launch Report: BMW 5-Series retains prestige status

25 January 2024

New Vehicles

New Vehicles

Launch Report: Toyota bZ4x faces considerable competition

30 November 2023

New Vehicles

New Vehicles

Launch Report: BYD Atto 3 is a strong Chinese contender in Europe

11 October 2023

Used vehicles

View more Used Vehicles

Used Vehicles

Monthly Market Update: Residual values down across European used-car markets in March

02 April 2024

Used Vehicles

Used Vehicles

How are used-LCV markets adapting across Europe?

15 March 2024

Used Vehicles

Used Vehicles

What are the most popular used cars in Romania?

12 March 2024

Used Vehicles

Used Vehicles

Monthly Market Update: Full hybrids fly high across European used-car markets in February

04 March 2024

Used Vehicles

Used Vehicles

Big five European used-car markets see improvement in fourth quarter

15 February 2024

Companies

View more Companies

Companies

Is there an automotive skills shortage?

11 April 2024

Companies

Companies

How successful was the 2024 Geneva International Motor Show?

08 March 2024

Companies

Companies

J.D. Power sets sights on European expansion with completion of Autovista Group acquisition

01 March 2024

Companies

Companies

Geneva International Motor Show gives glimpse of European automotive destiny

29 February 2024

Companies

Companies

How vulnerable is global automotive production?

28 February 2024

New vehicles

View more New Vehicles

New Vehicles

EU new-car market falls with double-digit BEV decline

22 April 2024

New Vehicles

New Vehicles

How did Europe’s big five new-car markets perform in the first quarter?

19 April 2024

New Vehicles

New Vehicles

UK LCV market received new plate boost in March

12 April 2024

New Vehicles

New Vehicles

Launch Report: Peugeot 3008 offers quality and style with bold design

10 April 2024

New Vehicles

New Vehicles

Even deeper decline for BEVs in German new-car market

09 April 2024

Tech

View more Tech

Tech

BYD stays at top of Chinese EV market while Aito and Wuling enjoy success

18 April 2024

Tech

Tech

How important are BEV battery health certificates?

17 April 2024

Tech

Tech

Tesla dominates European EV market in February

16 April 2024

Tech

Tech

BEVs struggle in global EV market during February

15 April 2024

Tech

Tech

What new electric vehicle technology can Europe expect?

05 April 2024

Region

View more Region

Region

How will the ZEV mandate affect the UK automotive market?

20 November 2023

Region

Region

Which Chinese automotive brands will succeed in Europe?

06 September 2023

Region

Region

Will Chinese BEVs dominate the European automotive market?

22 August 2023

Region

Region

What can be expected from Europe’s automotive markets in the second half of 2023?

16 August 2023

Region

Region

Companies race to make electric vehicle investments in South America

01 August 2023

Sustainability

View more sustainability

sustainability

What is the UK ZEV mandate?

28 March 2024

sustainability

sustainability

How have Euro 7 emission standards changed?

30 January 2024

sustainability

sustainability

Why have the Euro 7 emission standards changed?

25 October 2023

sustainability

sustainability

How will delaying the UK ban on new petrol and diesel cars impact the market?

21 September 2023

sustainability

sustainability

What is Euro 7 and the Euro standard?

24 May 2023