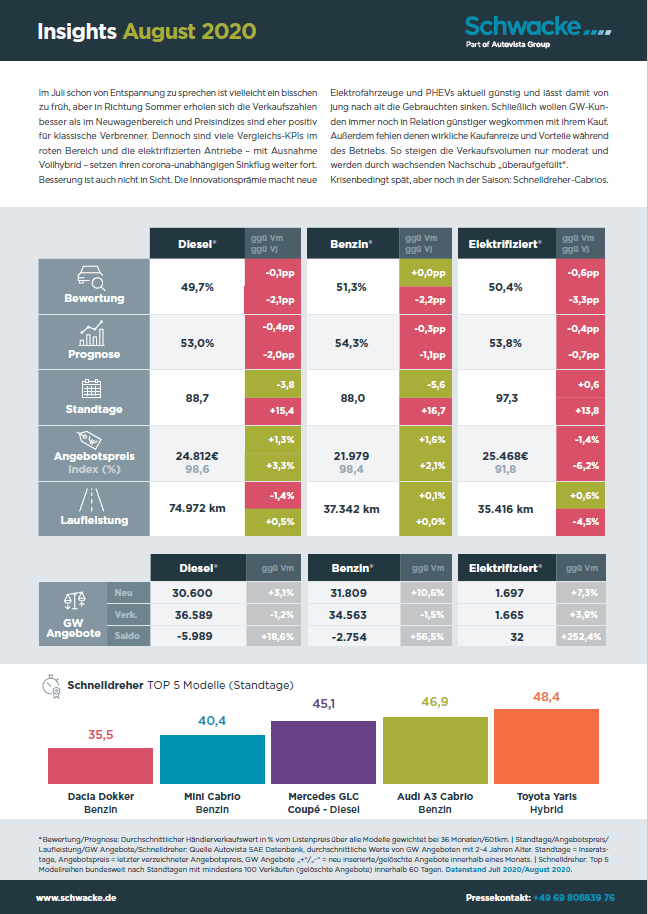

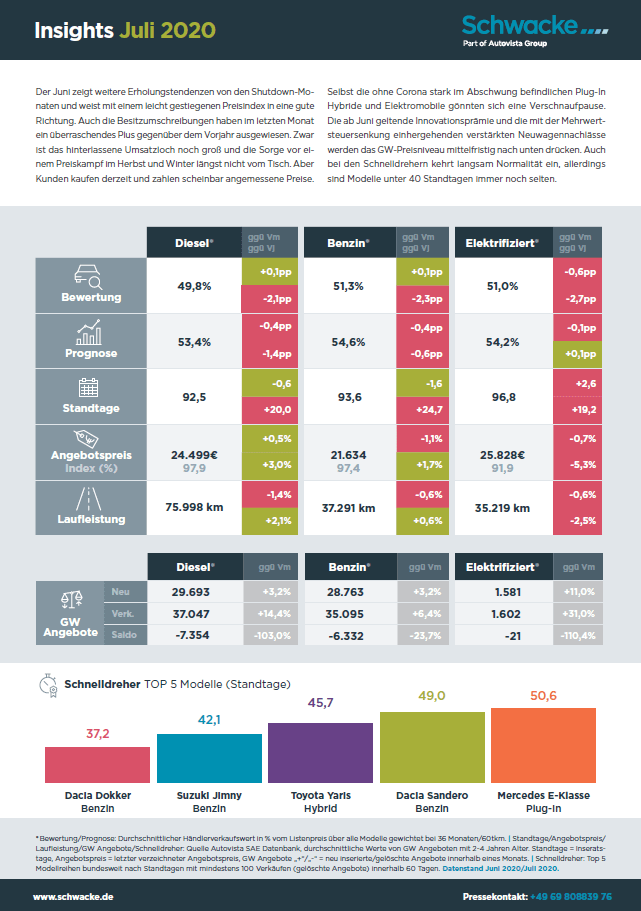

Im Juli schon von Entspannung zu sprechen ist vielleicht ein bisschen zu früh, aber in Richtung Sommer erholen sich die Verkaufszahlen besser als im Neuwagenbereich und Preisindizes sind eher positiv für klassische Verbrenner. Dennoch sind viele Vergleichs-KPIs im roten Bereich und die elektrifizierten Antriebe – mit Ausnahme Vollhybrid – setzen ihren corona-unabhängigen Sinkflug weiter fort.

Besserung ist auch nicht in Sicht. Die Innovationsprämie macht neue Elektrofahrzeuge und PHEVs aktuell günstig und lässt damit von jung nach alt die Gebrauchten sinken. Schließlich wollen GW-Kunden immer noch in Relation günstiger wegkommen mit ihrem Kauf. Außerdem fehlen denen wirkliche Kaufanreize und Vorteile während des Betriebs. So steigen die Verkaufsvolumen nur moderat und werden durch wachsenden Nachschub „überaufgefüllt“. Krisenbedingt spät, aber noch in der Saison: Schnelldreher-Cabrios.

Schließen

Schließen