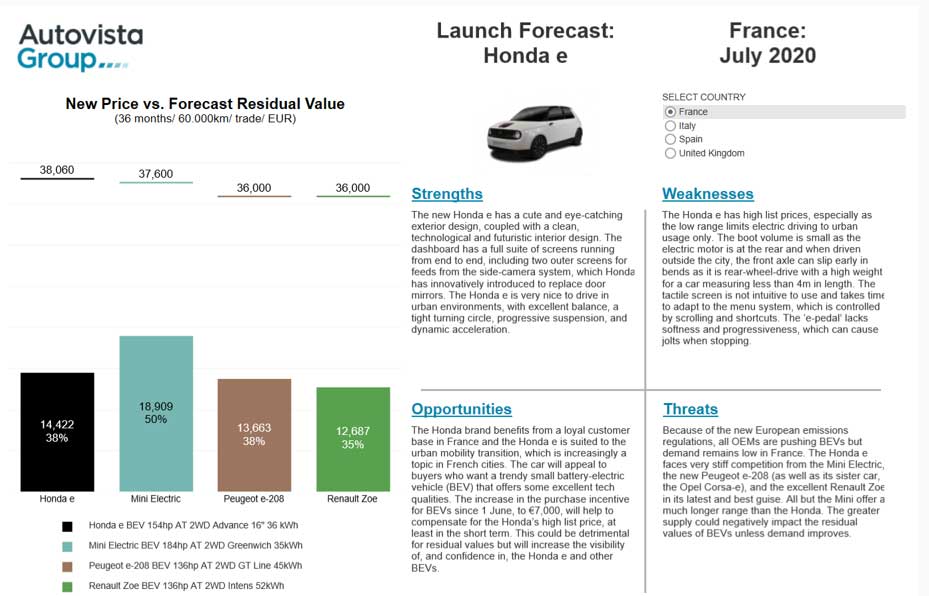

In-car infotainment systems appear to be expanding endlessly across cockpits, becoming more technologically advanced as they go. Examples range from the Honda e’s dashboard-wide multimedia suite to Tesla’s titanic touchscreen-driven approach. While this is great news for gadget lovers, it does raise issues around driver concentration.

Andy Cutler, car editor of forecast values at Glass’s, the UK arm of Autovista Group, recognises the increasingly distracting nature of touchscreen technology. He argues that drivers now need to navigate a number of on-screen menus to adjust features like climate control, even though this can be far more distracting than simply locating a physical button. Any time the driver spends looking away from the road is dangerous, and touchscreens have the potential to elongate this hazardous period.

Reaction times

This position was supported by the findings of a study published by the UK’s Transport Research Laboratory back in March. It found that the latest in-vehicle infotainment systems can impair driving reaction times more than alcohol and cannabis use. Reaction times slow by 12% at the drink-drive limit, which then decreases to 21% with cannabis. While using a touchscreen display with Android Auto or Apple CarPlay however, reaction times were more than 50% slower.

During the study, many participants realised the system was distracting them and tried to compensate by slowing down, for example. However, their performance was still adversely affected, with drivers unable to maintain a constant distance with the vehicle in front, reacting more slowly to sudden occurrences and deviating from their lane.

Drivers who took their eyes off the road for as long as 16 seconds while driving and using touch controls resulted in reaction times that were worse than texting while driving (35% slower reaction time). Some also underestimated the amount of time they spent looking away from the road by as much as five seconds when engaged with these infotainment systems.

Tesla touchscreen trouble

A German court case has highlighted the turning tide against this technology. A ruling was passed down that Tesla’s touchscreen controls should be treated as a distracting electronic device. The judgement was made as part of a case concerning a collision where the driver had been trying to adjust the windscreen-wiper settings.

The defendant found himself facing a fine and a ban, under the same rules used to prosecute those found using a mobile phone behind the wheel.

In March this year, the Higher Regional Court in Karlsruhe, known as the Oberlandesgericht (OLG) in German, heard a case that stemmed from a collision almost a year previously, a legal blog revealed. A Tesla Model 3 driver had been out in the rain when the car’s automated wipers activated.

Their speed can be automatically adjusted by the car to compensate for the amount of rainfall. However, manually changing the intervals is done via the central touchscreen in the middle of the cockpit, rather than on a button or dial.

In this case, the Tesla driver had to navigate software menus to choose from one of five settings after touching an icon on the screen. The court said that due to the ‘resulting loss of vision from the traffic’, the driver left his lane and ended up in an embankment, colliding with a sign and several trees.

The ruling

Following the incident, the driver was initially handed a €200 fine and a one-month ban from driving by a local court. This penalty came into line with the rules surrounding the use of a mobile phone while driving, namely, ‘Improper Use of an Electronic Device in Accordance with Section 23 (1a) of the Road Traffic Regulations.’ But the driver argued that the wiper controls were a safety-related feature which he needed to access, and so appealed to the OLG.

However, the higher court denied the appeal, agreeing with the initial ruling. It found that ‘the touchscreen (permanently installed in the vehicle of the Tesla brand) is an electronic device in the sense of § 23 Para, it does not matter what purpose the driver pursues with the operation.’

‘The setting of the functions required to operate the motor vehicle via the touchscreen (here: setting the wiping interval of the windshield wiper) is therefore only permitted if the view is only briefly adjusted to the screen for road, traffic, visibility and weather conditions and at the same time a corresponding turn away from the traffic is connected.’

So according to this ruling, a fixed touchscreen is an electronic device, even if it is only being used to adjust the wiper speed. The Daily Brief did reached out to Tesla for comment about this verdict, but the company has yet to respond.

Alternative cockpit systems

So manufacturers might need to take stock of touchscreen alternatives. This could mean multifunction dials on the steering wheel or a voice-activated command system, capable of carrying out tasks quickly and effectively.

For example, Polestar’s Precept concept boasts a 15-inch screen with Google Assistant providing advanced speech technology. However, vital information is displayed on a separate nine-inch horizontal display that utilises eye-tracking technology, allowing on-screen adjustments based on where the driver is looking.

Schließen

Schließen