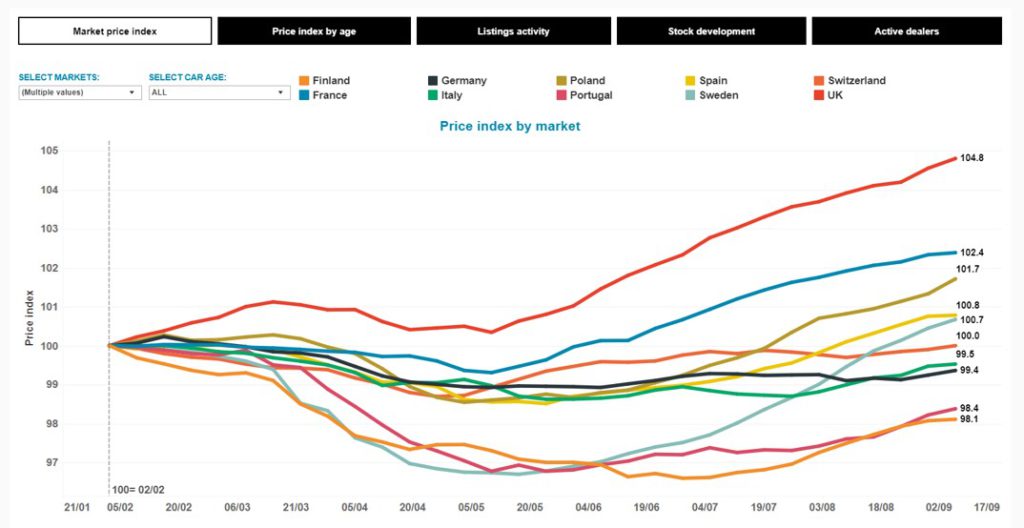

In its latest podcast, the Autovista Group Daily Brief team discusses Europe’s fluctuating registrations, developments in EV battery manufacturing and more complications arising from Brexit…

You can also listen and subscribe to receive further episodes direct to your mobile device on Apple, Spotify, Google Podcasts and search for Autovista Group Podcast on Amazon Music.

Schließen

Schließen